The Impact of COVID-19 is included in Carbon Black Market. Buy it today to get an advantage.

Request the impact of COVID-19 on your product or industry

The carbon black market is a crucial segment of the global chemical industry, serving diverse sectors such as automotive, construction, and packaging. Carbon black, a fine powder produced through the incomplete combustion of heavy petroleum products, possesses unique properties that make it an essential material in various applications. This report provides a comprehensive analysis of the carbon black market, including its market size, share, analysis, different types of carbon black, and key manufacturers.

Carbon Black Market Overview

Lucintel finds that the the future of the global carbon black market looks promising with opportunities in the transportation, industrial, and building and construction sectors. The global carbon black market is expected to reach an estimated $35.8 billion by 2030 with a CAGR of 6.9% from 2024 to 2030.The carbon black market has witnessed significant growth in recent years, driven by the increasing demand from end-use industries and the expansion of automotive and construction sectors worldwide. Carbon black is primarily used as reinforcing filler in rubber products, enhancing their strength, durability, and resistance to wear. Additionally, it finds applications in plastics, coatings, and inks due to its excellent UV resistance and color properties.

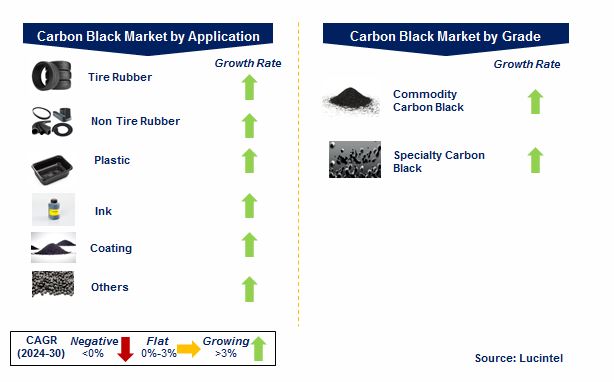

A total of 127 figures / charts and 120 tables are provided in this 254-page report to help in your business decisions. A sample figure with insights is shown below.

Emerging Trends in the Carbon Black Market

The carbon black market is poised for steady growth due to its wide range of applications across industries. The automotive sector, in particular, is a significant driver of demand, with carbon black being extensively used in the production of tires, hoses, belts, and other rubber components. As the global vehicle fleet expands, especially in emerging economies, the demand for carbon black is expected to witness substantial growth.

Furthermore, the construction industry plays a crucial role in driving the carbon black market. Carbon black is employed in various construction materials, such as roofing membranes, cables, pipes, and sealants, due to its excellent resistance to weathering, UV radiation, and physical stress.

Another emerging application of carbon black lies in the energy storage sector, particularly in lithium-ion batteries. Carbon black acts as a conductive additive in battery electrodes, improving their performance and longevity. As the demand for electric vehicles and renewable energy storage systems continues to rise, the carbon black market is anticipated to benefit from this trend. Emerging trends, which have a direct impact on the dynamics of the industry, include growing usage of recycled and bio-based carbon black and a shifting focus from commodities to more specialized grades of carbon black.

Carbon Black Market by Segment

This comprehensive market report provides a detailed analysis of the carbon black market, encompassing various aspects such as market size, segmentation, growth drivers, challenges, and emerging trends. It offers valuable insights into the competitive landscape, profiles of key players, and their strategies for market expansion. The report also highlights regional market dynamics, regulatory frameworks, and technological advancements impacting the carbon black market. The study includes a forecast for the global carbon black market by application, end use, grade, function, and region as follows:

Carbon Black Market by Application [Value ($M) and Volume (Kilotons) shipment analysis for 2018 – 2030]:

Carbon Black Market by End Use Industry [Value ($M) and Volume (Kilotons) shipment analysis for 2018 – 2030]:

Carbon Black Market by Grade [Value ($M) and Volume (Kilotons) shipment analysis for 2018 – 2030]:

Carbon Black Market by Function [Value ($M) and Volume (Kilotons) shipment analysis for 2018 – 2030]:

Carbon Black Market by Region [Value ($M) and Volume (Kilotons) shipment analysis for 2018 – 2030]:

-

North America

-

Europe

-

Asia Pacific

-

The Rest of the World

Carbon Black Market Share

The carbon black market has experienced substantial growth, with a rising market size attributed to its widespread use in various industries. The market is dominated by a few major players who hold a significant market share. These key players have established their position through technological advancements, extensive distribution networks, and strategic collaborations. However, the market also features several regional and local manufacturers, contributing to healthy competition and providing opportunities for niche markets.

Carbon Black Manufacturers

The carbon black market consists of several key manufacturers operating globally. These manufacturers play a significant role in meeting the growing demand for carbon black across various industries. Some of the prominent carbon black manufacturers include:

-

Birla Carbon

-

Cabot Corporation

-

Orion Engineered Carbons Holdings

-

OMSK Carbon Group

-

Tokai Carbon

-

Philips Carbon Black

-

Denka Company

-

Himadri Specialty Chemical

-

Imerys

-

Continental Carbon

These manufacturers employ advanced technologies, focus on product development, and maintain a robust distribution network to cater to the diverse requirements of customers worldwide.

Carbon Black Market Insight

-

Lucintel predicts that carbon black for tire rubber will remain the largest application segment over the forecast period, supported by increasing demand for passenger cars and light commercial vehicles.

-

Transportation will remain the largest end use industry during the forecast period, supported by increasing demand for tire and mechanical rubber goods.

-

Asia Pacific will remain the largest region by value and volume, and it is also expected to witness the highest growth over the forecast period, driven by higher vehicle production and shift of tire production to low-cost countries, such as India and China.

Features of Carbon Black Market

-

Market Size Estimates: Carbon black market size estimation in terms of value ($M) and volume (kilotons)

-

Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

-

Segmentation Analysis: Market size by application, end use, grade, and function

-

Regional Analysis: Carbon black market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

-

Growth Opportunities: Analysis of growth opportunities in different application, end use, grade, and function, and regions for the carbon black market.

-

Strategic Analysis: This includes M&A, new product development, and competitive landscape for the carbon black market.

-

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

Frequently Asked Questions (FAQ)

Q1. What is the carbon black market size?

Answer: The global carbon black market is expected to reach an estimated $35.8 billion by 2030.

Q2. What is the growth forecast for carbon black market?

Answer: The carbon black market is expected to grow at a CAGR of 6.9% from 2024 to 2030.

Q3. What are the key factors driving the growth of carbon black market?

Answer: The major drivers for this market are increasing tire production, growth in the plastic and coating market, and increasing penetration of specialty carbon black to enhance UV protection, pigmentation, and conductivity/anti-static properties in various applications

Q4. Who is the largest consumer of carbon black?

Answer: Transportation is the largest consumer of carbon black.

Q5. What are the key factors driving the growth of carbon black market?

Answer: Key factors, which have a direct impact on the dynamics of the industry, include growing usage of recycled and bio-based carbon black and a shifting focus from commodities to more specialized grades of carbon black.

Q6. Who are the key carbon black companies?

Answer: Some of the key carbon black companies are Birla Carbon, Cabot Corporation, Orion Engineered Carbons Holdings, OMSK Carbon Group, Tokai Carbon, Philips Carbon Black, Denka Company, Himadri Specialty Chemical, Imerys, Continental Carbon, etc.

Q7.Which carbon black application segment will be the largest in future?

Answer: Lucintel predicts that carbon black for tire rubber will remain the largest application segment over the forecast period, supported by increasing demand for passenger cars and light commercial vehicles.

Q8: In carbon black market, which region is expected to be the largest in next 5 years?

Answer: Asia Pacific is expected to remain the largest region and witness the good growth over next 5 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high growth opportunities for the global carbon black market by application (tire rubber, non-tire rubber, plastics, ink, coating, and others), end use industry (transportation, industrial, building and construction, printing and packaging, and others), grade (commodity carbon black and specialty carbon black), function (reinforcement, coloring, conductivity, UV protection, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?

For any questions related to carbon black market or related to carbon black market share, carbon black market size, carbon black market analysis, types of carbon black, and carbon black manufacturers, write to Lucintel analysts at helpdesk@lucintel.com. We will be glad to get back to you soon.