Securities Brokerage And Stock Exchange Market Trends and Forecast

The technologies in the securities brokerage and stock exchange market have undergone significant changes in recent years, with a shift from traditional manual order execution to algorithmic and high-frequency trading technologies. Additionally, the market has transitioned from offline trading platforms to online trading systems that offer real-time access and automated processes. There has also been a movement from legacy on-premise software to cloud-based platforms, enabling greater scalability, flexibility, and cost-efficiency. The use of blockchain technology has become increasingly prominent, replacing older centralized clearing and settlement systems with more secure and transparent decentralized models. Furthermore, the industry has evolved from physical brokerage offices to digital-only brokerage services, allowing clients to trade and manage their portfolios entirely through mobile and web-based platforms. These technological advancements have played a crucial role in enhancing market liquidity, operational efficiency, and customer accessibility.

Emerging Trends in the Securities Brokerage And Stock Exchange Market

The securities brokerage and stock exchange market has seen a dynamic evolution in recent years, driven by advancements in technology, changing regulatory landscapes, and shifts in investor behavior. These developments have led to greater accessibility, efficiency, and innovation in market operations. Emerging technologies such as AI, blockchain, and mobile trading platforms are significantly reshaping the way securities are traded and managed. The following are key trends that are shaping the market:

• AI and Machine Learning for Algorithmic Trading: Artificial intelligence (AI) and machine learning algorithms are revolutionizing trading strategies. These technologies enable brokers and exchanges to process vast amounts of data, predict market trends, and execute trades at optimal times, improving efficiency and profitability.

• Blockchain Integration for Transparency and Security: Blockchain technology is being increasingly adopted for its ability to enhance the transparency, security, and efficiency of transactions. It facilitates faster and more secure settlements, reducing the risks of fraud and counterparty default in securities transactions.

• Rise of Mobile and Online Trading Platforms: The demand for mobile trading apps and online platforms has surged, allowing investors to trade in real-time from anywhere. This has democratized access to the markets, empowering retail investors and increasing overall market participation.

• Growth of ESG (Environmental, Social, and Governance) Investing: Investors are placing greater emphasis on ESG factors when making investment decisions. This shift is driving stock exchanges and brokers to offer more ESG-compliant securities and to incorporate sustainability considerations into their platforms and products.

• Regulatory Evolution and Digital Compliance Tools: As the market evolves, so too do regulations. New digital compliance tools are being developed to ensure transparency and meet regulatory requirements, while brokers and exchanges implement AI-driven compliance solutions to manage risks and adhere to new standards.

In conclusion, these emerging trends AI and machine learning, blockchain, mobile platforms, ESG investing, and digital compliance tools are significantly reshaping the securities brokerage and stock exchange market. These technologies are fostering greater market efficiency, security, accessibility, and sustainability, ultimately creating a more transparent, dynamic, and accessible trading ecosystem for investors globally.

Securities Brokerage And Stock Exchange Market : Industry Potential, Technological Development, and Compliance Considerations

The securities brokerage and stock exchange market is undergoing a transformation driven by emerging technologies that are reshaping the way trading, brokerage, and market operations are conducted.

• Potential in Technology:

These technologies have the potential to drive greater efficiency, transparency, and security in the industry. One of the key technological advancements in this market is the shift from traditional offline trading systems to online platforms, allowing investors to access the markets in real-time, from anywhere in the world. The integration of blockchain technology holds significant potential to disrupt the market by offering a decentralized, secure method for clearing and settlement, reducing operational costs, and eliminating intermediaries.

• Degree of Disruption:

The degree of disruption from technologies such as algorithmic trading, AI, and machine learning is high, as these tools enhance decision-making, automate trading strategies, and increase market liquidity.

• Current Technology Maturity Level:

These technologies are still in varying stages of maturity, with AI and machine learning gaining traction, while blockchain is continuing to evolve and find widespread acceptance.

• Regulatory Compliance:

Regulatory compliance remains a significant concern, especially with the increasing reliance on automated trading systems. Regulatory bodies are implementing new frameworks to address the risks associated with algorithmic trading and to ensure market integrity. Overall, these technological advancements are accelerating market growth, increasing accessibility, and improving security, with a strong emphasis on regulatory adherence.

Recent Technological development in Securities Brokerage And Stock Exchange Market by Key Players

Recent developments in the securities brokerage and stock exchange market highlight the increasing importance of technological advancements, regulatory changes, and market dynamics. Key players in the market are adopting innovative solutions to enhance trading efficiency, improve transparency, and provide more accessible platforms for investors. These developments reflect the industryÄX%$%Xs response to growing investor demand for digitalization, cost-effectiveness, and a better user experience. Below are the recent developments from major players:

• Hong Kong Exchanges and Clearing (HKEX): HKEX has introduced a range of technological upgrades, including the integration of blockchain for securities settlement. The exchange aims to streamline trading processes and reduce settlement times, enhancing market efficiency and security.

• NYSE Group: The NYSE has focused on expanding its electronic trading capabilities, adopting AI-driven solutions for order execution and trading strategies. This shift is designed to improve speed, reduce human error, and increase overall trading volume.

• Interactive Brokers Group: Interactive Brokers has rolled out an advanced algorithmic trading platform and expanded its global reach. By leveraging automation and AI, the company aims to offer more efficient, cost-effective trading for institutional and retail investors alike.

• NASDAQ: NASDAQ has introduced innovations such as smart order routing and blockchain integration for enhanced transparency. Their focus on digital assets and cryptocurrency trading positions them as a leader in modern market platforms.

• Tokyo Stock Exchange (TSE): The TSE has implemented a new electronic trading system that offers increased processing speed and expanded product offerings. The exchange aims to attract more international investors with advanced technological solutions and more diverse trading options.

• London Stock Exchange Group: LSEG has been enhancing its trading infrastructure with cloud-based solutions to boost speed and reduce costs. Their focus on integrating fintech and blockchain solutions is designed to improve the trading process and offer enhanced services to market participants.

• Charles Schwab Corporation: Charles Schwab has shifted its focus towards mobile and online trading platforms, providing a seamless user experience for both retail and institutional investors. They are leveraging AI tools for better decision-making and trading efficiency.

• Euronext: Euronext has strengthened its position by acquiring the Oslo Børs VPS, enhancing its presence in the Nordic market. They are focusing on expanding their digital trading and clearing capabilities to offer a wider range of products.

• Morgan Stanley: Morgan Stanley is integrating advanced trading platforms, leveraging machine learning for improved decision-making in portfolio management and securities trading. They are expanding their offerings in digital asset management as well.

• CME Group: CME Group has continued to innovate with advanced derivatives and futures trading solutions. Their focus on blockchain technology for real-time clearing and settlement is helping to improve operational efficiencies.

These recent technological and strategic developments across key players in the securities brokerage and stock exchange market indicate a collective shift towards digitalization, improved efficiency, and the adoption of innovative solutions for a more transparent and accessible trading environment. This transformation is helping to drive growth and reshape the landscape of global financial markets.

Securities Brokerage And Stock Exchange Market Driver and Challenges

The securities brokerage and stock exchange market is undergoing significant transformation, driven by technological advancements, evolving market demands, and regulatory changes. The shift towards digitalization, automation, and increased focus on cost-efficiency is reshaping the way exchanges and brokerage firms operate. At the same time, these shifts come with both opportunities and challenges that impact market growth.

The factors responsible for driving the securities brokerage and stock exchange market include:

• Technological Advancements: The increasing adoption of AI, machine learning, blockchain, and other technologies is enhancing trading platforms, improving automation, and reducing costs, ultimately increasing the efficiency of the market. This has resulted in faster processing, better decision-making, and greater access for investors.

• Expansion of Digital and Mobile Trading Platforms: The growth of mobile trading apps and online platforms has opened the market to a wider audience, including retail investors. The convenience of trading from anywhere has driven increased participation and investment, fostering market growth and engagement.

• Increased Demand for Real-Time Data: Investors now expect real-time data, instant trade execution, and fast order matching. This demand has led to improved infrastructure, particularly in the areas of trading speed and transparency, benefiting exchanges and brokerage firms in meeting these needs.

• Globalization of Markets: The expansion of global markets has led to an increase in cross-border trading. Securities exchanges are integrating advanced solutions that facilitate cross-border transactions, driving market liquidity and increasing their global competitiveness.

• Regulatory Reforms: Stricter regulations around transparency, risk management, and market access have influenced market growth, leading to improved investor confidence. The adoption of blockchain and automation is also improving compliance with these regulations, facilitating smoother market operations.

Challenges in the securities brokerage and stock exchange market are:

• Regulatory Uncertainty: While regulatory reforms promote transparency, the constantly evolving nature of regulations can create uncertainty for exchanges and brokers, particularly with regard to global standards. This can cause compliance challenges and affect market operations.

• Cybersecurity Threats: As the market becomes more digitized, the risk of cyber threats increases. Exchanges and brokerage firms must invest heavily in cybersecurity infrastructure to protect both their platforms and customer data.

• Market Volatility: Rapid market changes and volatility can create risks for exchanges and brokers. Managing these fluctuations in a fast-paced environment requires advanced risk management strategies, which can be challenging for market participants.

The securities brokerage and stock exchange market is experiencing growth opportunities driven by technology, digitalization, and demand for transparency. However, challenges such as regulatory changes, cybersecurity threats, and market volatility continue to impact the marketÄX%$%Xs development. Despite these hurdles, the adoption of advanced solutions is helping to overcome these barriers, driving the market towards greater efficiency and accessibility.

List of Securities Brokerage And Stock Exchange Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies securities brokerage and stock exchange companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the securities brokerage and stock exchange companies profiled in this report include.

• Hong Kong Exchanges And Clearing (Hkex)

• Nyse Group

• Interactive Brokers Group

• Nasdaq

• Tokyo Stock Exchange (Tse)

• London Stock Exchange Group

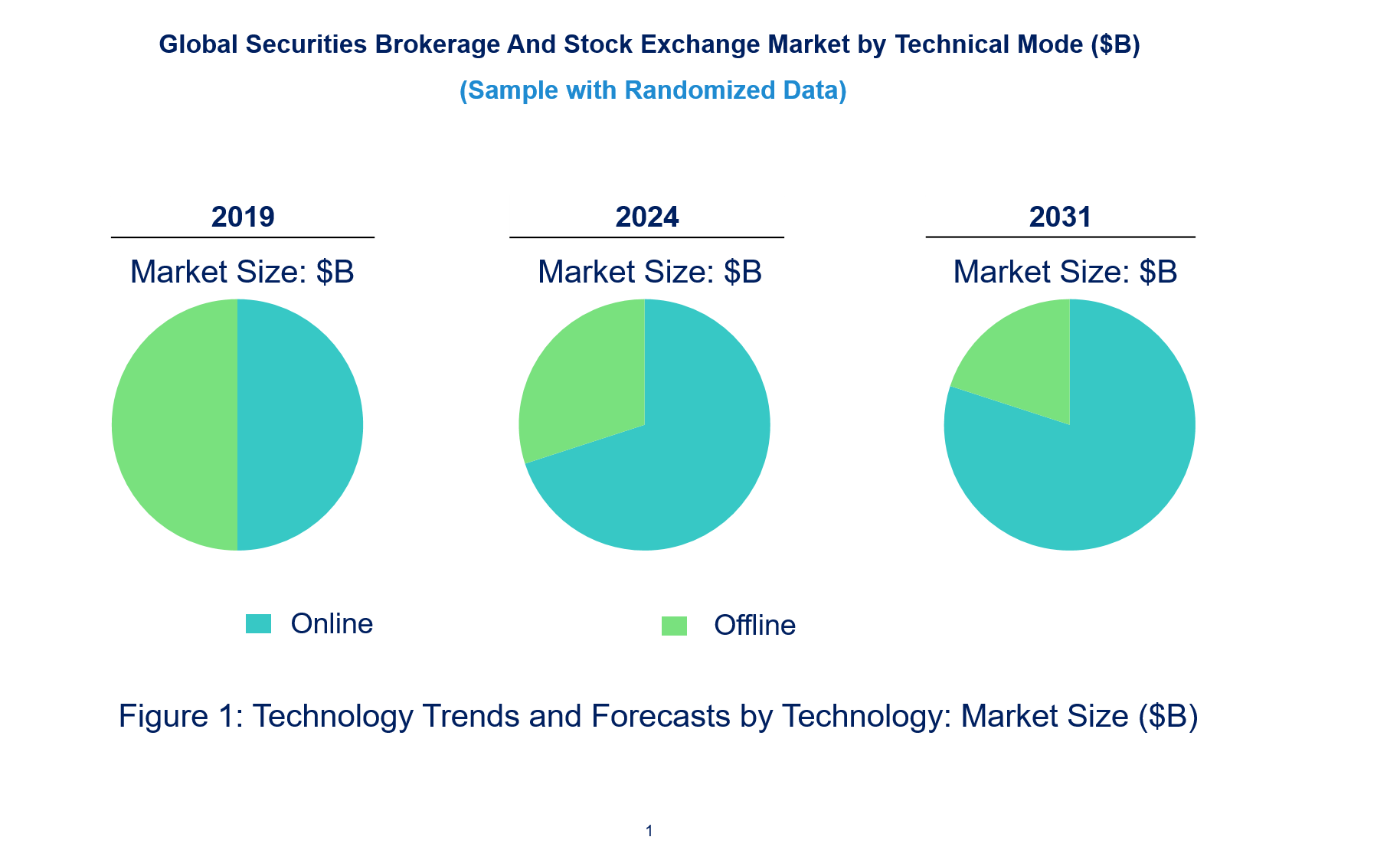

Securities Brokerage And Stock Exchange Market by Technology

• Technology Readiness by Technology Type: The technology readiness of online platforms in the securities brokerage and stock exchange market is high, as cloud-based trading systems, high-frequency trading algorithms, and mobile applications are already well-integrated into the market infrastructure. These technologies are highly competitive, offering real-time transactions, advanced analytics, and instant access to global markets. Regulatory compliance is a significant focus for online technologies, as they must adhere to strict security and privacy laws, with blockchain technology increasingly being explored to ensure transparent, immutable transactions. Offline platforms, while less competitive, still play a role in markets with limited internet infrastructure or where face-to-face transactions remain customary. These technologies are evolving to support remote and hybrid trading methods. However, the gap in efficiency, speed, and scalability between online and offline systems is widening, making online technologies the dominant force. Regulatory compliance for offline methods remains traditional, with more emphasis on physical documentation and less complex digital reporting. Overall, online technologies are reshaping the market landscape with better preparedness and competitive advantage, particularly in terms of compliance and application flexibility.

• Competitive Intensity and Regulatory Compliance: The competitive intensity between online and offline technologies in the securities brokerage and stock exchange market is rapidly increasing, as online platforms offer greater efficiency, scalability, and flexibility compared to offline systems. As online trading platforms dominate, traditional exchanges face pressure to adopt digital methods to stay competitive. However, regulatory compliance for online trading involves navigating complex issues related to data protection, cybersecurity, and cross-border trading regulations. Offline methods, while offering greater regulatory clarity in some regions, are becoming less adaptable to the changing market landscape, pushing regulators to adapt their frameworks for digital trading. Despite the challenges, both technologies are required to meet stringent regulatory standards, with online technologies particularly focused on real-time reporting and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. The regulatory burden remains an important consideration for all market participants, regardless of the trading platform they utilize.

• Disruption Potential by Technology Type: Online technologies, particularly mobile apps, cloud-based trading platforms, and algorithmic trading, are driving significant disruption in the securities brokerage and stock exchange market by enabling faster transactions, broader market access, and better data analytics. This shift from offline, manual trading processes to automated, real-time online platforms is reshaping the entire market structure. Traditional offline exchanges, though still relevant, are becoming less competitive due to the speed, cost efficiency, and ease of access offered by online technologies. Online technologies provide retail investors with opportunities to access real-time information and execute trades on demand, thus democratizing trading. Conversely, offline trading methods, though still in use in some regions, face growing obsolescence as investors demand faster, more efficient means of market participation. Ultimately, online technologies are driving innovation and transforming market dynamics, positioning themselves as the dominant force in this sector.

Securities Brokerage And Stock Exchange Market Trend and Forecast by Technology [Value from 2019 to 2031]:

• Online

• Offline

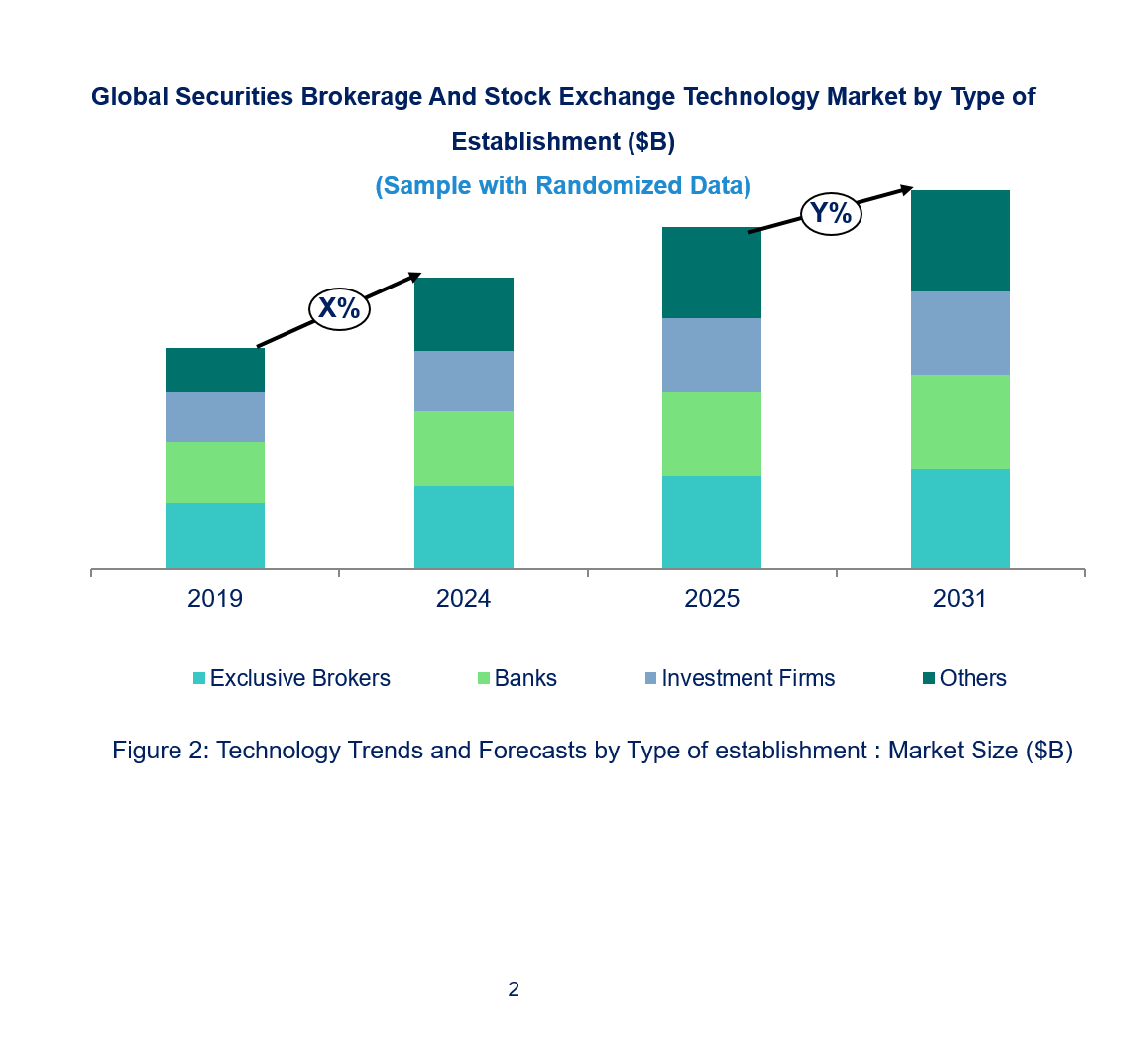

Securities Brokerage And Stock Exchange Market Trend and Forecast by Type of Establishment [Value from 2019 to 2031]:

• Exclusive Brokers

• Banks

• Investment Firms

• Others

Securities Brokerage And Stock Exchange Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Securities Brokerage And Stock Exchange Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Securities Brokerage And Stock Exchange Market

Market Size Estimates: Securities brokerage and stock exchange market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global securities brokerage and stock exchange market size by various segments, such as type of establishment and technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global securities brokerage and stock exchange market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different types of establishments, technologies, and regions for technology trends in the global securities brokerage and stock exchange market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global securities brokerage and stock exchange market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global securities brokerage and stock exchange market by technology (online and offline), type of establishment (exclusive brokers, banks, investment firms, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different technology? What are the drivers and challenges of these technologies in the global securities brokerage and stock exchange market?

Q.5. What are the business risks and threats to the technology trends in the global securities brokerage and stock exchange market?

Q.6. What are the emerging trends in these technical mode in the global securities brokerage and stock exchange market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global securities brokerage and stock exchange market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global securities brokerage and stock exchange market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this securities brokerage and stock exchange technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global securities brokerage and stock exchange market?