Phenolic Resins in Global Composites Market Trends and Forecast

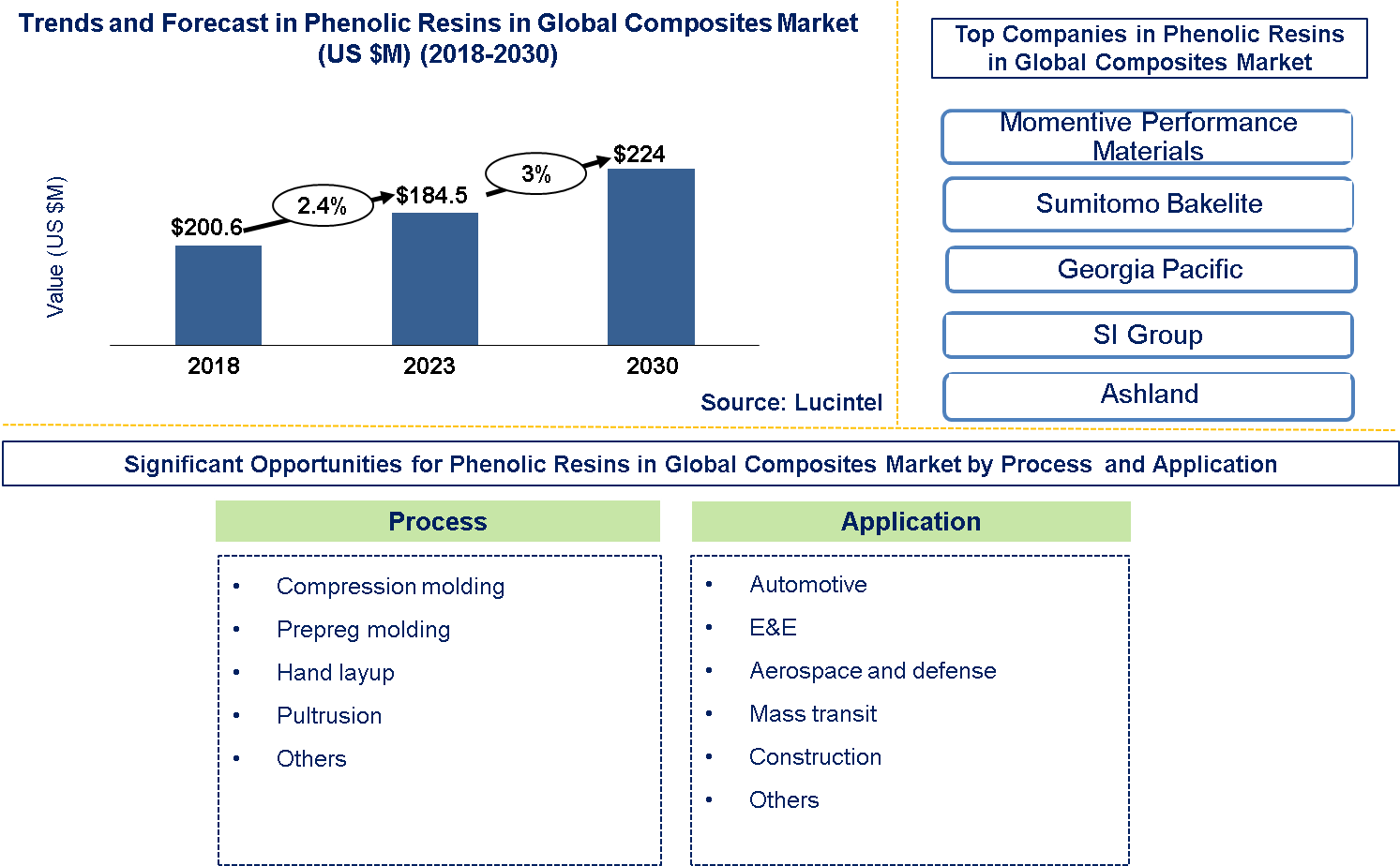

Lucintel finds that the future of the phenolic resins in the global composites market looks promising with growth opportunities in the automotive, E&E, aerospace and defense, mass transit, construction, and others application. The phenolic resins in the global composites market is expected to reach an estimated $224 million by 2030 with a CAGR of 3% from 2024 to 2030. The major drivers of growth for this market are high heat resistance, fire resistance, mechanical strength, and cost-effectiveness.

Raw materials for the manufacture of phenolic resins include phenol and formaldehyde. These are mixed with different curing agents, fillers (such as silica or glass fibers) and additives that improve performance. The blend is then subjected to polymerization to form thermosetting resin utilized in various applications in composite technology. The price range for these products is typically from $2 up to $5 per pound depending on the formulation and application. As compared to competitors, phenolic resins are an economic alternative since they have long-lasting features, can withstand high heat levels, and low cost of production hence they are priced favorably against other thermosetting resins used in composites sector.

• Lucintel forecasts that the automotive segment will remain the largest application segment over the forecast period. Electrical and Electronics is expected to witness the highest growth over the forecast period.

• Asia Pacific is expected to remain the largest region and witness the highest growth over the forecast period due to growth in application industries such as automotive, aerospace and defense, mass transit, construction, and growing electrical and electronics demand.

Country wise Outlook for the Phenolic Resins in Global Composites Market

The Phenolic resins in the global composites market is witnessing substantial growth globally. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major PPEK producers in key regions: the USA, Germany, China, India, and Brazil.

Emerging Trends in the Phenolic Resins in Global Composites Market

Emerging trends in the Phenolic Resins in Global Composites Market shaping its future applications and market dynamics:

1. Development of Low VOCs & Low-Emission Resins: It should also be noted that stricter environmental regulations and better work environment necessitate development of low-VOC emission phenolic resins.

2. Nanotech Integration: In addition, nano particles can enhance various characteristics of the composites such as their strength and durability when added to phenolics. Incorporation of nanomaterials into phenolic resins aims at enhancing their properties.

3. Innovation of Fire Retardancy: Thereby, recent innovations have further improved these properties making them even more effective for applications that need tight fire safety codes using phenolic resins that possess these inherent features.

4. Improved Thermal Stability: Phenolic resins can now be made more thermally stable by new formulations that allow them to be applied in higher temperature operations such as those in the automotive and aerospace industries, which require high-temperature performance features.

5. Environment Friendly Formulations: A trend towards greener phenolic resin technologies is being witnessed. These range from the use of bio-based phenols instead of those derived from petroleum and an attempt at lowering environmental impact due to petrol usage.

These trends reflect the dynamic nature of the phenolic resin in the composites market, driven by innovation, sustainability, and the need for high-performance materials across various industries.

A total of 107 figures / charts and 68 tables are provided in this 205-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Phenolic Resins in Global Composites Market

Recent developments in Phenolic resins in the global composites market by various companies highlight ongoing innovations and advancements across different sectors:

1. Technological Advancements: Phenolic resin formulations have undergone advancements to improve performance characteristics such as fire resistance, chemical stability and mechanical strength. New phenolic resins that are hybrids of traditional phenolic resins and other types of resins are being developed for specific applications. As a sustainable practice in manufacturing, the use of eco-friendly phenolic resins is gaining momentum. For instance, these include efforts towards increased use of renewable raw materials and reduction in volatile organic compounds (VOCs).

2. Market Trends: The aerospace and defense industries are increasingly using phenolic resins because they have excellent fire retardancy and thermal stability. This is a high growth sector where companies are investing heavily in research and development. The automotive industry uses phenolic resins so as to lighten up the composite parts which make them more durable. Thus, this is motivated by the need for fuel economy along with safety in automobiles.

3. Regional Developments: China and India especially have experienced significant rise in use of phenolic resins due to booming construction as well as the automobile sectors within Asia Pacific region. Local manufacturers enhance their production capabilities by expanding their product lines to meet regional demands. Innovation and performance improvement are key focus areas within Europe and North America respectively. Such companies invest on expensive researches to come up with high-performance phenol formaldehyde resin grades suited for different applications including high temperature resistant or flame-resistant conditions.

4. Competitive Landscape: Major players such as BASF, Huntsman, Melamine Chemicals among others are coming up with new products while at the same time increasing their production capacities in order to stay ahead of their competitors within the phenolics market. In order for firms to be competitive they engage themselves through acquisitions mergers and partnerships so that they can increase their market share and get access to new technologies. An example is a strategic alliance between resin suppliers and end-users to create specialty phenolic resins.

5. Emerging Applications: Green Building Products: Fire resistant nature of phenolic resins is increasing their use in green building materials. There have been improvements in this area in terms of the environmental footprint. Improved Phenolic Resin grades are being developed for electrical and electronic applications because they have good insulation properties.

Strategic Growth Opportunities for Phenolic Resins in Global Composites Market

The phenolic resin market is very dynamic due to its unique properties of being lightweight, strong and thermally stable. Some key strategic growth opportunities for this market include:

1. Aerospace and Defense: Phenolic resins are known for superior thermal stability and flame retardance. This makes them the right fit for aerospace and defense applications where they need high performance in extreme conditions. Utilization of phenolic resins in advanced composites for aircraft structures, military equipment, is on the rise. They have excellent mechanical properties and longevity that are essential in these modernized industries.

2. Automotive: Lightweight Solutions: As a result of the auto sector’s desire to gain mileage by reducing weight, phenolic resin can participate in making lightweight but strong materials. The fire resistance property of this product matches with the current increased car safety requirements around the globe.

3. Construction: Durability and Weather Resistance: Phenolic resins offer excellent durability and weathering characteristics which make them appropriate for construction applications such as panels, floors, façade materials among others. The construction industry has embraced sustainable materials. Therefore, when used in sustainable composite solutions, phenolic resins can tap into this growing market segment.

4. Electrical and Electronics: Electrical Insulation: Phenolic resins have been used majorly in electrical insulating materials because of their good electrical qualities. With the rising electronics and electrical sectors there may be an opportunity for phenolics to increase their market share here. The demand for high-performance electronic materials including those that must tolerate high temperatures or provide insulation creates growth opportunities.

5. Industrial Applications: Chemical Resistance: Phenolic resins are chemically resistant hence suitable for different industrial applications like tanks, pipes among other equipment exposed to severe chemicals. In addition to that, industries may consider cost-effective options with high performance hence making it competitive alternative material.

Phenolic Resins in Global Composites Market Drivers and Challenges

The global composites market is driven by the high heat and fire resistance, cost effectiveness and mechanical strength of phenolic resins. Nonetheless, they face stiff competition from advanced resin alternatives due to their fragility, processing complexity and environmental concerns.

The key drivers for the global Phenolic resins in the global composites market include:

1. High Temperature Resistance: Phenolic resins are popular for their good thermal stability, they are therefore applicable in high temperature uses like those in the motor vehicles and aerospace.

2. Fire proofing: Their outstanding fire retardant properties make them suitable for applications that require strict safety standards such as materials used in construction and electronics.

3. Mechanical Strength: Phenolic resins have strong mechanical features which include high tensile and impact strength that is useful for structural use.

4. Affordability: When compared with other advanced resin systems, phenolic resins can be less expensive hence preferred for budget-conscious projects.

5. Sustainable considerations: Reduction of environmental impact is an area of interest in phenolic resins such as use of bio-based phenolics or improving recycling techniques.

The challenges in the global Phenolic resins in the global composites market include:

1. Brittleness: In certain circumstances, products involving phenolic resins may be restricted by its brittleness when flexibility or high impact resistance is required.

2. Processing difficulties: The curing process of phenolic resins can be more complex and time-consuming than other types of resin, thus affecting production efficiency.

3. Raw Material Shortages: The manufacture of these resins has to depend on certain chemical feed-stocks whose availability might be disrupted at any point in time due to supply chain issues or price changes.

4. Environmental Concerns: Traditional phenolic resins still release formaldehyde even though efforts have been made to reduce this. This remains a major concern unlike for other lower environmental impact alternatives among the various classes of resin.

5. Competition against other Resin Systems: Such advanced resin forms as epoxies or thermoplastic resins offer better characteristics than those found in some instances with phenolics including enhanced flexibility; lighter weight; easier processing etc.

Even with some notable merits, phenolic resins meet stiff competition in the world composites market. Enhancing their competitiveness would require addressing brittleness, complex processing and environmental consequences that narrow their area of use.

Phenolic Resin Suppliers and Their Market Shares

In this globally competitive market, several key players such as Momentive Performance Materials, Sumitomo Bakelite, Georgia Pacific, SI Group, and Ashland etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players, contact us by email at helpdesk@lucintel.com. If you wish to deep dive in competitive positioning of these players then you can look into our other syndicated market report on “Phenolic Resins in Global Composites Market Leadership Report". Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies Phenolic resins in the global composites market cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the phenolic resin companies profiled in this report include.

• Momentive Performance Materials

• Sumitomo Bakelite

• Georgia Pacific

• SI Group

• Ashland

These companies have established themselves as leaders in the phenolic resins in the global composites market, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations. The market share dynamics within the Phenolic resins in the global composites market are evolving, with the entry of new players and the emergence of innovative Phenolic resins in the global composites market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Phenolic Resins in Global Composites Market by Segment

In the worldwide market of composite materials, phenolic resins are demonstrating a remarkable upward trend in sectors like aerospace, automotive and construction due to their excellent flame retardancy and heat resistance. In view of the fact that phenolic adhesives offer lightness coupled with strength, aviation applications are growing. The rising demand for strong and lightweight raw materials drives growth in the automobile industry. Construction benefits from fire retardant properties of phenolic resins. Other competitive products include epoxy and polyester resins, which have some advantages such as cost-effectiveness and versatility. Phenolic resins are distinctly different from other types of composites thus making them highly sought after in high performance but niche areas characterized by extremely demanding conditions.

Global Phenolic Resins in Global Composites Market by Application [Value ($M) and Volume (M lbs) Shipment Analysis for 2018 – 2030]:

• Automotive

• E&E

• Aerospace and defense

• Mass transit

• Construction

• Others

Global Phenolic Resins in Global Composites Market by Process [Value ($M) and Volume (M lbs) Shipment Analysis for 2018 – 2030]:

• Compression molding

• Prepreg molding

• Hand layup

• Poltrusion

• Other

Global Phenolic Resins in Global Composites Market by Region [Value ($M) and Volume (M lbs) Shipment Analysis for 2018 – 2030]:

• North America

• Europe

• APAC

• ROW

Features of Phenolic Resins in Global Composites Market

• Market Size Estimates: Phenolic Resins market size estimation in terms of value ($B) and volume (B lbs)

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by application, and region

• Regional Analysis: Phenolic Resins market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different application, and regions for the Phenolic resins in the global composites market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the phenolic resin market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in Phenolic resins in the global composites market or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What are the Phenolic resins in the global composites market size?

Answer: The phenolic resins in the global composites market is expected to reach an estimated $224 million by 2030.

Q2. What is the growth forecast for phenolic resin market?

Answer: The phenolic resin market is expected to grow at a CAGR of 3% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the phenolic resin market?

Answer: The major drivers of growth for this market are increasing high heat resistance, fire resistance, mechanical strength, and cost-effectiveness.

Q4. What are the major applications or end use industries for Global Phenolic Resin?

Answer: Construction and electrical & electronics are the major end uses for phenolic resins in the global composites.

Q5. What are the emerging trends in phenolic resin market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include development of low-voc and low-emissions resins, nanotech integration, innovation of fire retardancy, and improved thermal stability.

Q6. Who are the key phenolic resin companies?

Answer: Some of the key phenolic resin companies are as follows:

• Momentive Performance Materials

• Sumitomo Bakelite

• Georgia Pacific

• SI Group

• Ashland

Q7.Which phenolic resin type segment will be the largest in future?

Answer: Lucintel forecasts that the molding compounds segment will remain the largest segment over the forecast period due to high heat resistance, mechanical strength and electrical properties and is used in automotive, aerospace, electronics and industrial market.

Q8: In phenolic resin market, which region is expected to be the largest in next 7 years?

Answer: APAC is expected to remain the largest region over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising, high-growth in phenolic resins in the global composites market by application (automotive, electrical and electronics, aerospace and defense, mass transit, construction , and others ) and region (North America, Europe, Asia Pacific and ROW)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 6 years in this market?