Pharmaceutical Label Market Trends and Forecast

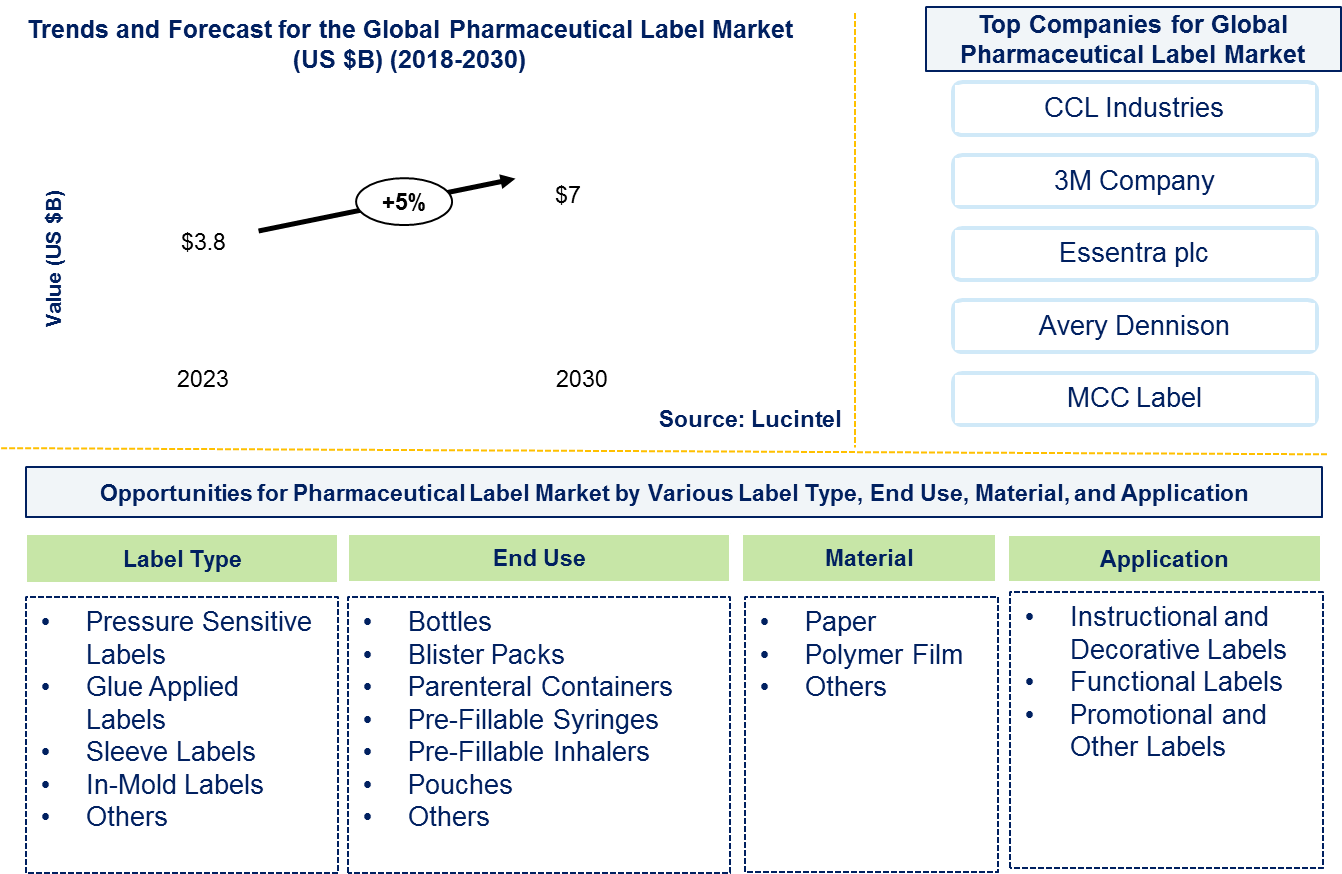

The future of the pharmaceutical label market in the global healthcare industry looks promising with opportunities in the bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, and pouches. The global pharmaceutical label market is expected to reach an estimated $7 billion by 2030 with a CAGR of 5% from 2023 to 2030. The major drivers for this market are growth in the pharmaceutical industry along with growing healthcare expenditures in developing economies.

The main raw materials used for Pharmaceutical labels include paper, plastic films (such as polyethylene or polypropylene), adhesives (acrylic or rubber-based), inks (UV-resistant or thermal-transfer), and security features like holograms or RFID/NFC tags. The price of Pharmaceutical labels varies based on materials, complexity (e.g., security features), volume, and regulatory compliance requirements. Higher-quality materials and advanced features may increase costs compared to basic labels, but competitive pricing is influenced by market demand and supplier competition.

• Lucintel forecasts that the pressure sensitive labels will remain the largest segment over the forecast period because these labels are versatile, convenient to use, and available in different designs and patterns. The sleeve label segment is expected to witness the highest growth during the forecast period because this label can be used for 360° degree branding and messaging of the product.

• Within the global pharmaceutical label market, bottles will remain the largest end use segment over the forecast period because they provide convenience, safety, and security for solid, liquid, and ophthalmic medication.

• Paper and polymer film are used for pharmaceutical labeling. Lucintel forecasts that the polymer film will remain the largest over the forecast period due to its variety of grades and significant barrier properties.

• North America is expected to remain the largest region due to recent technological advancements in pharmaceutical labels. APAC is expected to witness the highest growth rate over the forecast period due to its growing pharmaceutical industry and stronger prevention of counterfeit pharmaceutical products.

Country wise Outlook for the Pharmaceutical Label Market

The pharmaceutical label market is witnessing substantial growth globally, driven by increased demand from various industries such as aerospace, automotive, wind energy, and construction. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major pharmaceutical label producers in key regions: the USA, Germany, China, South Korea, and Japan.

Emerging Trends in the Pharmaceutical Label

Emerging trends in the pharmaceutical label market shaping its future applications and market dynamics:

• Improving Stock Management and Product Security: Improving stock management as well as product security and authentication in supply chain through real-time tracking and RFID or NFC integration.

• Increasingly Adopted as Advanced Security: Counterfeiting drugs are fought by holograms, tamper-evident seals, and unique identifiers which are increasingly adopted as advanced security measures to authenticate products.

• Growing Demand for Digitalization: For this reason, digital printing that is made on demand for personalized labeling has been in use so as to improve its effectiveness, flexibility and compliance with the regulations.

• Increasing Demand for Eco-Friendly Label Materials: Regulatory pressures and a preference for environmentally friendly products have fueled the demand for eco-friendly label materials and packaging solutions.

A more than 150 page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments in the Pharmaceutical Label Market

Ongoing innovations and advancements in various sectors of the pharmaceutical label market which have been highlighted by recent developments:

• Smart Labeling Technologies: Combining the use of RFID and NFC technologies to facilitate the real-time tracking and authentication of pharmaceutical products across the supply chain. These technologies improve supply chain visibility, inventory management, and fight fake drugs.

• Anti-counterfeit Solutions: Holograms, tamper-evident seals, unique identifiers, among other technologies that can be used in improving anti-counterfeit labeling. This progress guarantees genuineness of products as well as secure patients against counterfeit drugs.

• Digital Printing Innovations: Adoption for pharmaceutical labels of digital printing technologies that enable on-demand printing, variable data printing (VDP) and customization. Digital printing is flexible, reduces lead time and aids compliance with regulations.

• Sustainability Initiatives: Achieving higher environmental standards through labeling materials and packaging solutions. Such initiatives involve finding eco-friendly sources of raw materials, creating recyclable packaging options while enhancing the overall sustainability profile of pharmaceutical labeling.

Strategic Growth Opportunities for Pharmaceutical Label Market

The pharmaceutical label market is very dynamic due to its unique properties of in regulatory compliance and security measures, including anti-counterfeit technologies, ensuring patient safety and adherence to stringent industry standards. Some key strategic growth opportunities for this market include:

Technology Advancements and Innovation:

• Pharmaceutical labeling is being revolutionized by the fusion of modern technology such as RFID, NFC, and digital printing. These technologies allow for tracking in real time, authentication and measures against counterfeit that enhance the supply chain efficiency as well as patient safety. As technology advances more smart labels can be created with additional functions such as temperature monitoring of biologics and electronic monitoring of patient compliance.

Increased Regulatory Demands:

• The pharmaceutical industry is heavily regulated throughout the world. FDA (USA), EMA (Europe) amongst others have laws and regulations on the use of drugs which necessitate drug usage instructions which are accurate and drug dosage quantities. This increasing complexity provides an opportunity for label manufacturers to provide simple solutions aimed at improving compliance while ensuring observance to regulatory standards.

Increasing Demand for Anti-Counterfeit Solutions:

• In recent times, there has been a growing need for robust anti-counterfeiting labeling solutions due to rising cases of counterfeit pharmaceutical products that pose great danger to public health. The product authenticity can be verified with technologies like holograms, tamper-evident seals, unique identifiers, etc., which also prevent fake drugs’ spread inside the market. Therefore, this presents an opportunity for label manufacturers to design advanced anti-counterfeit applications as companies become increasingly concerned about patients’ safety and brand reputation.

Personalized Medicine & Patient Centric Approaches:

• Pharmaceutical labels must possess variable data printing (VDP) capabilities enabling them accommodate personalized medicine requirements along with customized information provision Labels may include individual dosages for patients among other things like treatment schedules or language preference Label manufacturers should exploit this trend by implementing flexible labeling solutions that will meet different individual patient demands without breaking any law put in place by relevant authorities.

Sustainability Initiatives:

• All industries are increasingly focusing on sustainability including pharmaceuticals packaging and labeling. As part of these efforts, label manufacturers are looking into sustainable materials, recyclable packaging alternatives, and reducing environmental impacts associated with their labeling activities. In this way, there is a chance for a label manufacturer to differentiate itself by providing sustainable labeling options as many pharmaceutical companies are now taking up sustainability goals and the consumers have preferences for products that are environment friendly.

Global Expansion & Emerging Markets:

• With improved healthcare infrastructure and increased access to medication, the pharmaceutical industry has expanded globally particularly in emerging markets. This presents an opportunity for label manufacturers to enter new markets through adaptability of their solutions to meet cultural preferences and local regulatory requirements. Entry into these markets can be easier when strategic alliances or collaboration is forged between distributors, pharma companies and label manufacturers.

By taking advantage of these strategic growth opportunities, the pharmaceutical label market can realize its full potential and transform numerous industries through enhanced safety, efficiency, and global supply chain integrity.

Pharmaceutical Label Market Driver and Challenges

Pharmaceutical labels are indispensable across industries, ensuring regulatory compliance, patient safety, and supply chain integrity by providing critical information on medication usage, dosage, and authenticity. They serve as vital tools in maintaining healthcare standards and safeguarding public health worldwide.

The factors responsible for driving the pharmaceutical label market include:

1. Regulatory Compliance: The world’s strictest legislations have to be put in place so that from all over the globe it is possible to get clear and right information about dosage, safety recommendations and drug uses.

2. Technological Advancements: Incorporation of smart labeling techniques for example RFID/NFC within labels, which improves supply chain visibility and also prevents counterfeiting.

3. Demand for Anti-counterfeit Solutions: Migrant counterfeit drugs market is boosting growth of high-tech labeling technologies that help ensure product genuineness in order to safeguard patient lives.

4. Personalized Medicine: Trend towards personalized medicine needs flexible labels that can accommodate patient-specific dosages.

5. Global Expansion of Healthcare: Increased healthcare infrastructure and access to medicines in emerging markets necessitate informative pharmaceutical labels that are complaint with regulations.

Challenges in the pharmaceutical label market are:

1. Complex Regulatory Landscape: Different regions have diverse and ever-changing regulatory requirements making it difficult for manufacturers of pharmaceutical labels to comply with them.

2. Cost Constraints: There may be competitive price pressure but at the same time one has to invest in advanced labelling technology and meet regulatory requirements as well

3. Counterfeit Drug Threats: Improvements in anti-counterfeit labeling solutions should correspondingly involve adaptation to dynamic bogus methods thus making them more complex and expensive.

4. Technological Integration: It becomes a challenge when incorporating smart label technologies into complicated pharmaceutical supply chains

5. Environmental Sustainability: There is need for eco-friendly materials on the label. Also, there are imposed performance demands by relevant authorities hence these two should balance against environmental impact.

Innovations in material science and manufacturing processes have sparked a surge in demand for pharmaceutical labels. Unique developments include the use of ultra-thin, high-barrier films that enhance drug protection and shelf life. Additionally, advancements in digital printing technology allow for personalized and variable data printing, improving traceability and patient safety. Moreover, the integration of RFID and NFC technologies enables real-time monitoring and authentication throughout the supply chain, boosting efficiency and security in pharmaceutical logistics.

Pharmaceutical Label Suppliers and Their Market Shares

In this globally competitive market, several key players such as CCL Industries, Inc., 3M, Essentra, Avery Dennison Corporation, MCC Label, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies pharmaceutical label companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the pharmaceutical label companies profiled in this report includes:

• CCL Industries

• 3M

• Essentra

• Avery Dennison Corporation

• MCC Label

• SATO Holding Corporation

• Consolidated Label

These companies have established themselves as leaders in the pharmaceutical label industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the pharmaceutical label market are evolving, with the entry of new players and the emergence of innovative pharmaceutical label technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Pharmaceutical Label Market by Segment

Major segments of pharmaceutical labels experiencing growth include increasing demand for smart labels with RFID or NFC technology for enhanced tracking and patient engagement, as well as labels that facilitate multilingual information to cater to global markets and regulatory requirements.

This pharmaceutical label report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including pharmaceutical label types, manufacturing processes label type, material, application, and end use industry. The report offers insights into regional dynamics, highlighting the major markets for pharmaceutical label and their growth potentials. The study includes trends and forecast for the global pharmaceutical label market by label type, material, application, end use industry, and region as follows:

Pharmaceutical Label Market By Label Type [Value ($M) from 2018 to 2030]:

• Pressure-sensitive labels

• Glue-applied labels

• Sleeve labels

• In-mold labels

• Others

Pharmaceutical Label Market By Material [Value ($M) from 2018 to 2030]:

• Paper

• Polymer film

• Others

Pharmaceutical Label Market By Application [Value ($M) from 2018 to 2030]:

• Instructional and decorative labeling

• Functional labeling

• Promotional and other labeling

Pharmaceutical Label Market By End Use [Value ($M) from 2018 to 2030]:

• Bottles

• Blister packs

• Parenteral containers

• Pre-fillable syringes

• Pre-fillable inhalers

• Pouches

• Others

Pharmaceutical Label Market By Region [Value ($M) from 2018 to 2030]:

• North America

o United States

o Canada

o Mexico

• Europe

o Germany

o France

o United Kingdom

• APAC

o China

o Japan

o India

• ROW

o Brazil

Features of Pharmaceutical Label Market

• Market Size Estimates: Pharmaceutical label market in the global healthcare industry market size estimation in terms of value ($M) shipment.

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Pharmaceutical label market in the global healthcare industry market size by various segments, such as label type, material, application, end use industry, and regions in terms of value.

• Regional Analysis: Pharmaceutical label market in the global healthcare industry breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis on growth opportunities in different label type, material, application, end use industry and regions for pharmaceutical label market in the global healthcare industry.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the pharmaceutical label in the global healthcare industry.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the pharmaceutical label market size?

Answer: The global pharmaceutical label market is expected to reach an estimated $7.6 billion by 2027.

Q2. What is the growth forecast for pharmaceutical label market?

Answer: The pharmaceutical label market is expected to grow at a CAGR of ~6% from 2022 to 2027.

Q3. What are the major drivers influencing the growth of the pharmaceutical label market?

Answer: The major drivers for this market are growth in the pharmaceutical industry along with growing healthcare expenditures in developing economies.

Q4. What are the major applications or end use industries for pharmaceutical label?

Answer: Bottles, blister packs, parenteral containers, pre-fillable syringes, pre-fillable inhalers, and pouches are the major end use for pharmaceutical label

Q5. What are the emerging trends in pharmaceutical label market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, includes improving stock management and product security, increasingly adopted as advanced security, growing demand for digitalization, and increasing demand for eco-friendly label materials.

Q6. Who are the key pharmaceutical label companies?

Answer: Some of the key pharmaceutical label companies are as follows:

• CCL Industries

• 3M Company

• Essentra

• Avery Dennison Corporation

• MCC Label

• SATO Holding Corporation

• Consolidated Label

Q7. Which pharmaceutical label product segment will be the largest in forecast period?

Answer: Lucintel forecasts that pressure sensitive labels will remain the largest segment over the forecast period because these labels are versatile, convenient to use, and available in different designs and patterns.

Q8. In pharmaceutical label market, which region is expected to be the largest in next 5 years?

Answer: North America will remain the largest region and Asia Pacific expected to witness the highest growth over next 5 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising potential, high-growth opportunities for the pharmaceutical label in the global healthcare industry by label (pressure sensitive label, glue applied label, sleeve label, in mold label, and others), material (paper, polymer film, and others), application (instructional and decorative label, functional label, promotional and other label) end use (bottles, parenteral containers, blister packs, pre-fillable syringes, pre-fillable inhalers, pouches, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the pharmaceutical label in the global healthcare industry?

Q.5 What are the business risks and threats to the pharmaceutical label in the global healthcare industry?

Q.6 What are emerging trends in this pharmaceutical label in the global healthcare industry and the reasons behind them?

Q.7 What are some changing demands of customers in the pharmaceutical label in the global healthcare industry?

Q.8 What are the new developments in the pharmaceutical label in the global healthcare industry? Which companies are leading these developments?

Q.9 Who are the major players in the pharmaceutical label in the global healthcare industry? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the pharmaceutical label in the global healthcare industry, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the pharmaceutical label in the global healthcare industry?

For any questions related to pharmaceutical label market or related to PAN based pharmaceutical label, pitch based pharmaceutical label, pharmaceutical label in automotive, pharmaceutical label in aerospace, pharmaceutical label in industrial, pharmaceutical label manufacturers, pharmaceutical label top companies, pharmaceutical label suppliers, write Lucintel analyst at email: helpdesk@lucintel.com. We will be glad to get back to you soon.