Industrial Clutches and Brakes Market Trends and Forecast

The technologies in the industrial clutches and brakes market have undergone significant changes in recent years, with a shift from traditional mechanical and pneumatic systems to more electric and electromagnetic solutions. This transition is driven by the increasing demand for more efficient, precise, and energy-efficient systems in industries like mining, construction, and industrial production. Electric and electromagnetic clutches and brakes are becoming more prevalent due to their ability to provide better control, faster response times, and lower maintenance costs compared to their mechanical counterparts. Additionally, pneumatic and hydraulic systems are being refined to meet the evolving needs of applications requiring high torque and performance under harsh conditions, while innovations in electric systems offer higher integration with modern digital technologies, enabling remote monitoring and control. These technological shifts aim to enhance system performance, reduce downtime, and improve energy efficiency across a range of industries, significantly reshaping the landscape of the industrial clutches and brakes market.

Emerging Trends in the Industrial Clutches and Brakes Market

The industrial clutches and brakes market is evolving rapidly due to advancements in technology and the increasing demand for more efficient and reliable solutions. Key emerging trends include:

• Increasing Demand for Electric Clutches and Brakes: Electric clutches and brakes are gaining traction due to their efficiency, precision, and ease of integration with automated systems. They are increasingly being used in sectors such as mining and manufacturing, where performance and energy efficiency are critical.

• Technological Integration with IoT: The integration of industrial clutches and brakes with Internet of Things (IoT) technology allows for real-time monitoring and predictive maintenance, reducing downtime and improving system longevity. This trend is becoming prominent in industries like logistics and material handling.

• Shift Towards Energy-Efficient Solutions: There is a growing focus on energy-efficient solutions as industries seek to reduce operational costs and environmental impact. Electric and electromagnetic clutches are more energy-efficient compared to traditional mechanical and pneumatic alternatives.

• Customization and Advanced Control Systems: There is an increasing need for customizable clutches and brakes that can be tailored to specific applications. Advanced control systems enable precise adjustments, leading to better performance and higher reliability in applications like power generation and industrial production.

• Automated Systems and Robotics: The rise of automation and robotics in industrial sectors is driving the demand for more reliable and efficient clutches and brakes. These systems require high-performance, low-maintenance components that can operate continuously under demanding conditions.

These trends are shaping the future of the industrial clutches and brakes market by driving innovations in efficiency, performance, and connectivity. As automation and energy efficiency continue to dominate the industrial landscape, clutches and brakes will evolve to meet the new demands of these sectors.

Industrial Clutches and Brakes Market : Industry Potential, Technological Development, and Compliance Considerations

The industrial clutches and brakes market has witnessed significant technological advancements, particularly in electric, pneumatic, hydraulic, and electromagnetic systems. These innovations are poised to reshape various industries, including manufacturing, mining, logistics, and power generation, by improving efficiency, precision, and safety.

• Technology Potential:

The growing demand for automation and energy efficiency has unlocked significant potential for electric and electromagnetic clutches and brakes, which offer better control and lower energy consumption compared to traditional mechanical systems. Hydraulic and pneumatic systems are increasingly being optimized for heavier industrial applications, offering improved power transmission capabilities in environments like mining and construction.

• Degree of Disruption:

Electric and electromagnetic clutches are leading the disruption in the market, enabling highly precise control over machinery, reducing mechanical wear, and providing opportunities for real-time monitoring and integration with Industry 4.0 technologies. These advancements enable seamless automation and integration into digital systems, enhancing performance across industrial sectors.

•Technology Maturity:

While pneumatic and hydraulic clutches have reached a high level of maturity, electric and electromagnetic technologies are rapidly advancing. The adoption of smart technologies and IoT-enabled systems is still emerging but is expected to become more widespread as industries seek improved performance and reduced downtime.

• Regulatory Compliance:

Industrial clutches and brakes are subject to stringent regulations, particularly in sectors like power generation, aerospace, and automotive, where safety and performance are critical. Manufacturers must adhere to global safety standards, such as ISO certifications, to ensure that their products meet both performance and safety benchmarks.

The industrial clutches and brakes market is on the cusp of transformation, driven by advancements in electric, pneumatic, hydraulic, and electromagnetic technologies. As these innovations mature, they hold the potential to disrupt industries by enhancing energy efficiency, automation, and performance. However, maintaining regulatory compliance remains a critical factor in the continued success of these technologies.

Recent Technological development in Industrial Clutches and Brakes Market by Key Players

The industrial clutches and brakes market has seen a range of recent developments, particularly with key players focusing on innovation and expanding their product portfolios to meet the demands of various industries.

• Altra Industrial Motion Corp has been advancing its electromagnetic and electric clutch technologies, providing more energy-efficient solutions for industries such as mining and industrial production. Their recent developments aim to integrate smart monitoring capabilities to further reduce maintenance costs.

• The Carlyle Johnson Machine Company, LLC has introduced advanced mechanical and pneumatic brake systems that provide improved torque handling for heavy-duty applications, especially in the construction and mining sectors. Their designs focus on higher reliability and durability under extreme operational conditions.

• Eaton Corporation Plc has been at the forefront of developing integrated brake systems for the automotive and logistics sectors. They have launched new electric-powered clutches and brakes with enhanced performance and reduced environmental impact, in line with global sustainability goals.

• Johnson Industries Ltd has been focusing on specialized clutches and brake systems for industrial production and power generation sectors, particularly in applications requiring precision and safety. Their products are now equipped with automated control features for smoother operation.

• Hindon Corporation has introduced cutting-edge pneumatic and hydraulic brake systems designed to meet the growing demands of the aerospace and defense sectors. Their latest innovations improve both operational efficiency and safety in high-stakes environments.

These developments highlight the ongoing shift towards more energy-efficient, precise, and high-performance clutch and brake solutions. As companies continue to innovate and adapt to market needs, the industrial clutches and brakes market is set to grow further, driven by advancements in automation, energy efficiency, and IoT integration.

Industrial Clutches and Brakes Market Driver and Challenges

The industrial clutches and brakes market is experiencing significant growth, driven by various factors such as technological advancements and industry-specific needs. However, the market also faces certain challenges that may hinder growth.

The factors responsible for driving the global industrial clutches and brakes market are:

• Increased Automation in Industrial Sectors: The growing trend of automation in manufacturing, logistics, and other industrial sectors is driving the demand for high-performance clutches and brakes that can function in automated systems and machinery.

• Energy Efficiency Demand: Rising energy costs and sustainability concerns are pushing industries to adopt energy-efficient solutions, which is contributing to the growing demand for electric and electromagnetic clutches and brakes.

• Technological Advancements: Continuous innovations in electric, pneumatic, and hydraulic systems, such as the integration of IoT and smart sensors, are enhancing the performance and functionality of industrial clutches and brakes, creating new growth opportunities.

• Industrialization in Emerging Markets: The ongoing industrialization in emerging markets is driving the demand for industrial machinery and components, including clutches and brakes, as industries look to expand production capacities.

Challenges facing the global industrial clutches and brakes market are:

• High Initial Costs: The adoption of advanced clutches and brake systems often requires a significant upfront investment, particularly in electric and electromagnetic solutions, which may deter small- and medium-sized enterprises (SMEs).

• Complexity in Maintenance: While advanced systems offer better performance, they may also require more specialized maintenance, which can be a challenge for industries with limited technical expertise or resources.

• Competition from Alternative Technologies: The presence of alternative technologies, such as servo motors and other braking systems, can pose a threat to the market growth of traditional industrial clutches and brakes, especially in highly competitive sectors.

The market for industrial clutches and brakes is poised for growth due to factors such as increased automation, demand for energy-efficient solutions, and continuous technological advancements. However, challenges such as high initial costs and competition from alternative technologies need to be addressed to fully realize market potential.

List of Industrial Clutches and Brakes Companies

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies industrial clutches and brakes companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the industrial clutches and brakes companies profiled in this report includes.

• Altra Industrial Motion Corp.

• The Carlyle Johnson Machine Company

• Eaton Corporation

• Johnson Industries Ltd.

• Hindon Corporation

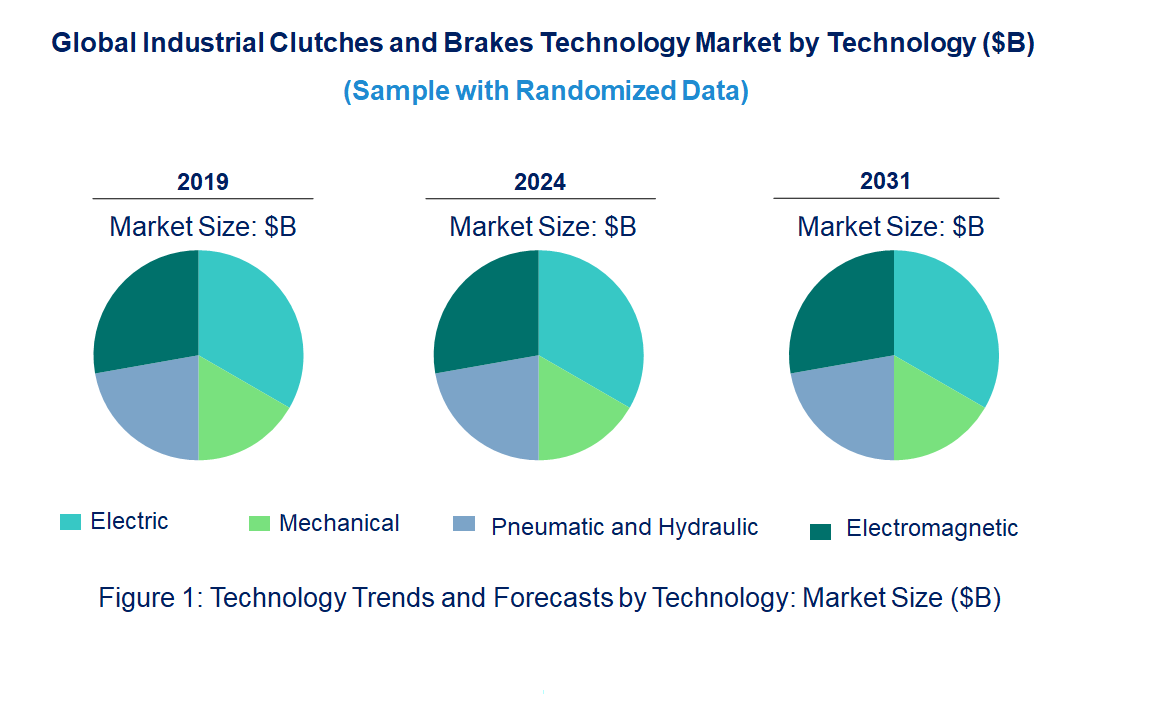

Industrial Clutches and Brakes Market by Technology

• Technology Readiness by Technology Type: Electric clutches are highly competitive and technologically mature, with growing adoption in automation and energy-efficient applications. They offer improved precision and control over mechanical systems, which remain widely used but are less flexible and efficient. Pneumatic and hydraulic clutches are well-established and widely used in industries like mining and construction, where high power and robustness are required. However, their environmental impact and efficiency are driving a shift towards more sustainable technologies. Electromagnetic clutches, still emerging, hold great potential for disruption due to their advanced control and integration with smart systems. They are highly suitable for automated applications but face challenges in scalability and cost. All technologies must comply with stringent safety standards and regulations, especially in critical industries like aerospace, automotive, and power generation. While mechanical and pneumatic systems are established, newer technologies like electric and electromagnetic clutches are setting the stage for the next wave of innovation in the industrial clutches and brakes market.

• Competitive Intensity and Regulatory Compliance: The competitive intensity in the industrial clutches and brakes market is high, with companies continually innovating to meet demand for more efficient, durable, and precise systems. Electric and electromagnetic clutches face increased competition as industries transition towards automation and energy-efficient solutions. Pneumatic and hydraulic systems remain dominant in heavy-duty applications like mining and construction, where power density is key. However, they also face regulatory pressure to improve energy efficiency and reduce environmental impacts. All technologies must comply with strict industry standards and safety regulations, particularly in the power generation and automotive sectors. Regulatory frameworks such as ISO certifications and environmental norms drive product development and influence market competition. As a result, manufacturers must balance innovation with compliance to stay competitive.

• Disruption Potential of Different Technologies for Industrial Clutches and Brakes Market: The disruption potential of various clutch and brake technologies lies in their ability to improve performance, efficiency, and integration into modern automation systems. Electric and electromagnetic clutches offer precise control, energy efficiency, and real-time monitoring, enabling smarter and more automated systems. Pneumatic and hydraulic systems are well-suited for high-power applications, but they may not provide the same level of flexibility or energy efficiency as electric alternatives. Mechanical systems remain widely used but are limited in terms of automation and precision. The emergence of smart technologies such as electromagnetic systems promises greater control and reduced maintenance costs, marking a shift from traditional mechanical clutches. As industries adopt more advanced technologies, the potential for disruptive innovation increases, particularly in sectors requiring high reliability and precision, such as aerospace and automotive.

Industrial Clutches and Brakes Market Trend and Forecast by Technology [Value from 2019 to 2031]:

• Electric

• Mechanical

• Pneumatic & Hydraulic

• Electromagnetic

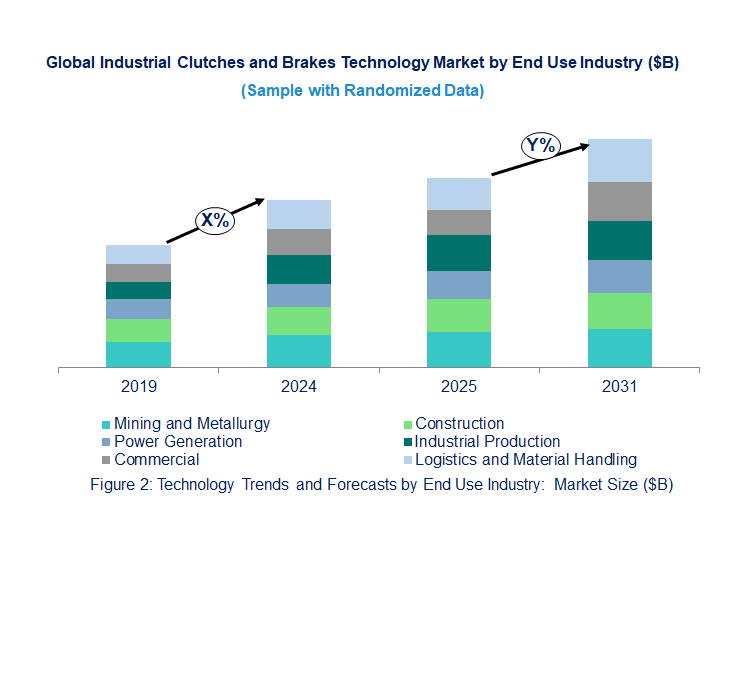

Industrial Clutches and Brakes Market Trend and Forecast by End Use [Value from 2019 to 2031]:

• Mining & Metallurgy

• Construction

• Power Generation

• Industrial Production

• Commercial

• Logistics and Material Handling

Industrial Clutches and Brakes Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Industrial Clutches and Brakes Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Industrial Clutches and Brakes Market

Market Size Estimates: Industrial clutches and brakes market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global industrial clutches and brakes market size by various segments, such as end use and technology in terms of value and volume shipments.

Regional Analysis: Technology trends in the global industrial clutches and brakes market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different end uses, technologies, and regions for technology trends in the global industrial clutches and brakes market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global industrial clutches and brakes market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global industrial clutches and brakes market by technology (electric, mechanical, pneumatic & hydraulic, and electromagnetic), end use (mining & metallurgy, construction, power generation, industrial production, commercial, logistics, and material handling ), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different technology? What are the drivers and challenges of these technologies in the global industrial clutches and brakes market?

Q.5. What are the business risks and threats to the technology trends in the global industrial clutches and brakes market?

Q.6. What are the emerging trends in these technologies in the global industrial clutches and brakes market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global industrial clutches and brakes market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global industrial clutches and brakes market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this industrial clutches and brakes technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global industrial clutches and brakes market?