Indian uPVC Doors and Windows Market Trends and Forecast

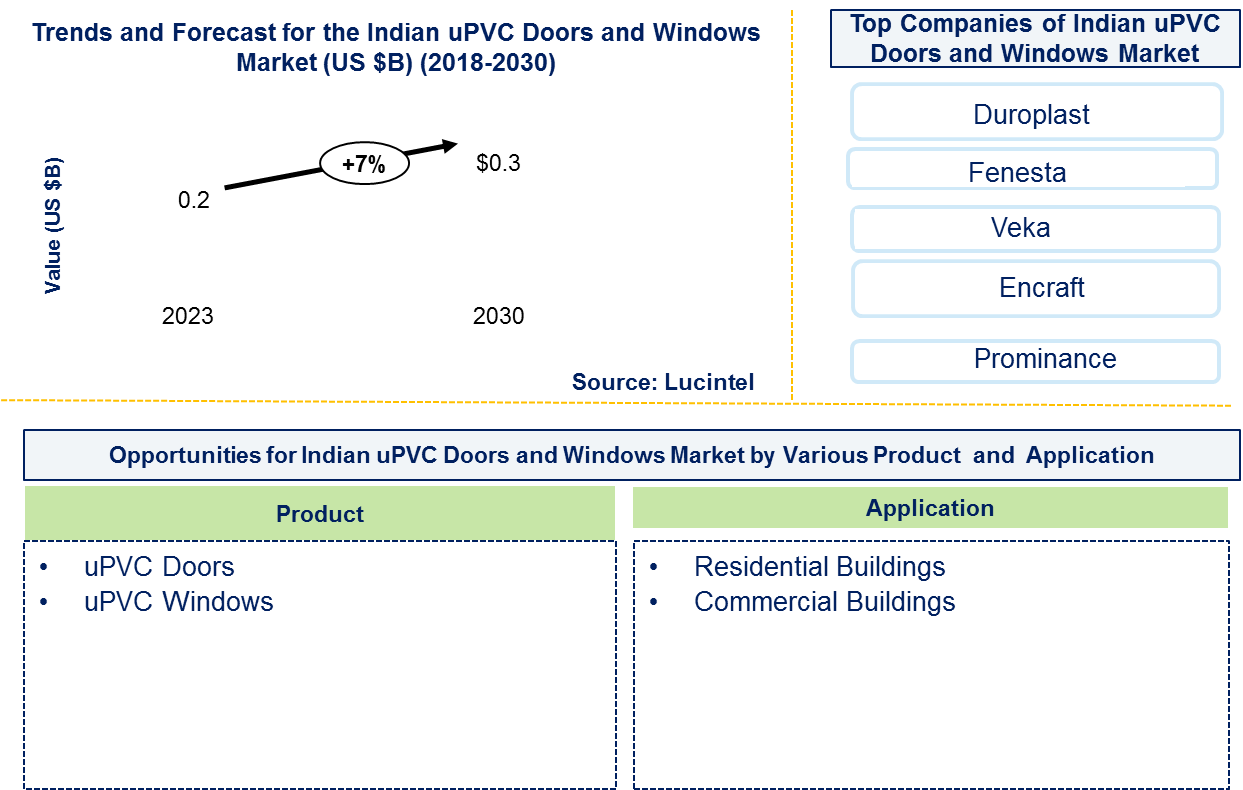

The future of the uPVC doors and windows market in India in India looks promising with opportunities in the residential and commercial construction sectors. The major drivers for this market are growth in construction activities and increasing awareness towards sustainable, weather resistant, and cost effective construction practices. The uPVC doors and windows market in India has experienced remarkable expansion in recent years, and there is a projected substantial growth trajectory with an anticipated CAGR surpassing ~7% throughout the forecast period spanning from 2023 to 2030.

Indian uPVC doors and windows typically use raw materials like unplasticized polyvinyl chloride (uPVC) resin, stabilizers, pigments, and additives. These components ensure durability, weather resistance, and thermal insulation in the final products. In terms of pricing, the Indian uPVC doors and windows market generally offers competitive pricing compared to traditional wooden or aluminum alternatives. The affordability is enhanced by local manufacturing and widespread availability of uPVC materials in the region.

• On the basis of its comprehensive research, Lucintel forecasts that the Indian uPVC doors and windows market is expected to depict a high growth .

• uPVC windows market will remain the largest segment in terms of both value during the forecast period. Increasing building construction activities is the major driving force of the industry.

Country wise Outlook for the Indian uPVC Doors and Windows Market

The Indian uPVC doors and windows market is witnessing substantial growth globally, driven by several factors. These include increasing urbanization, rising disposable incomes, a growing emphasis on energy-efficient construction solutions, and government initiatives promoting sustainable building practices. Below image highlights recent developments by major Indian uPVC doors and windows market producers in key regions: India

Emerging Trends in the Indian uPVC Doors and Windows Market

Emerging trends in the Indian uPVC doors and windows market shaping its future applications and market dynamics:

• Reducing Heating and Cooling Costs: The increasing attention to conserving energy has created a demand for uPVC doors and windows which boast of excellent thermal insulation properties thus reducing heating and cooling costs.

• Growing Sense of Environmental Awareness: A growing sense of environmental awareness is encouraging the adoption of sustainable building materials. This is why it matters when uPVC can be recycled and are energy efficient hence fitting well into green building certifications as well as sustainable construction practices.

• Technological Innovations in Manufacturing: The quality, durability and performance of uPVC are being improved through technological innovations in manufacturing. They are thereby made to conform to industry standards while meeting regulatory requirements.

• Urbanization and Infrastructure Development: Quick urbanization coupled with infrastructure initiatives has greatly propelled the need for high-end building products like uPVC especially in urban centers where space utilization plays a significant role alongside noise abatement.

A more than 150 page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments in the Indian uPVC Doors and Windows Market

Ongoing innovations and advancements in various sectors of the electric bicycle market in Australia which have been highlighted by recent developments:

• Market Expansion: Penetration into new geographical areas driven by urbanization, infrastructure development, and government housing schemes.

• Quality Standards: Adherence to international quality standards and certifications to ensure product reliability and performance.

• Digital Marketing and Sales: Increasing use of online platforms for marketing, sales, and customer engagement.

• Partnerships and Collaborations: Formation of strategic partnerships between uPVC manufacturers, architects, and builders to promote uPVC products in construction projects.

• Regulatory Support: Government policies promoting energy-efficient building materials and sustainable construction practices.

• Consumer Education: Efforts to educate consumers about the benefits of uPVC doors and windows, driving higher adoption rates in residential and commercial sectors.

Strategic Growth Opportunities for Indian uPVC Doors and Windows Market

The Indian uPVC doors and windows market is very dynamic due to its unique properties of durability, low maintenance, thermal insulation, and resistance to weathering and corrosion. Some key strategic growth opportunities for this market include:

Increase of Urbanization and Infrastructure Development:

• India is undergoing rapid urbanization, which has led to an increase in demand for high-quality building materials that possess durability, energy efficiency, and aesthetic appeal. Urban residential and commercial developments can be ideally matched by uPVC doors and windows meeting these criteria. The market also expands due to infrastructure projects such as smart cities and affordable housing schemes.

Growth of Awareness and Demand for Energy Efficiency:

• A rise in energy prices coupled with environmental concerns has created a heightened awareness on the benefits of using energy efficient construction materials. They have great thermal insulation quality that leads to reduced energy consumption needed for heating and cooling purposes. Such advantages can encourage adoption especially in regions with harsh weather patterns.

Increased Technology Advancements:

• Ongoing innovations in formulation of uPVCs plus modern manufacturing techniques enhance product performance as well as longevity. Progresses made in extrusion technology see the design becoming complicated alongside options for customization to suit different architectural styles or consumer tastes. Moreover, incorporating IoT based features like automation and power use control will further strengthen its appeal among end-users.

Sustainable Measures:

• The shift towards sustainable building practices favors uPVC products due to their recyclability, low environmental impact when compared to conventional materials like timber or aluminum among others. These aspects can attract customers who are environmentally aware thus aligning with green building certifications.

Government Backing And Policies:

• For uPVC doors & windows; government initiatives promoting affordable housing solutions, smart cities promotion strategies plus energy-efficient construction materials act as positive regulatory backgrounds. Some examples of incentives may involve tax incentives or subsidies provided when green certification programs have been met, which can encourage developers and consumers to adopt uPVC products.

Digital Transformation And Marketing:

• Manufacturing processes, customer engagement and marketing efforts are some of the areas where digital technologies can be adopted into so as to improve efficiency and expand the market base. For instance, factory direct online platforms serve as a way through which uPVC manufacturers may provide customers with information about their product features plus offer them virtual consultations in an effort to improve customer service hence penetrate markets better than others while at the same time enhancing brand visibility.

Collaborations And Partnerships:

• The adoption of uPVC at large-scale projects like forming strategic relationships with architects, builders, and real estate developers is made possible by these forms of collaborations. Such collaborations seek product innovation or market expansion along with advocating for uPVC as a preferred construction material thus making use of the combined expertise and networks.

Consumer Education And Awareness Programs:

• Creating awareness on durability, low maintenance costs, energy efficiency and sustainability that comes with using uPVC doors & windows is crucial for expanding the market. Awareness campaigns targeting misconceptions in form of workshops, seminars or even digital content that highlights uPVC’s superiority over traditional alternatives should be conducted.

By taking advantage of these strategic growth opportunities, the Indian uPVC doors and windows market can solidify its leadership, meet rising demand for high-quality construction materials, and drive substantial market growth domestically and internationally.

Indian uPVC Doors and Windows Market Driver and Challenges

The Indian uPVC doors and windows market plays a crucial role in advancing sustainable construction practices by offering energy-efficient solutions that reduce carbon footprints. It supports urban development initiatives with durable, low-maintenance products suitable for diverse architectural styles.

The factors responsible for driving the Indian uPVC doors and windows market include:

1. Energy Efficiency: Boosting consciousness about energy-saving building materials as well as regulatory support for that purpose is responsible for the increase in demand of uPVC doors and windows with excellent insulation properties.

2. Urbanization and Infrastructure Development: Rapid urbanization and infrastructure growth have propelled the market since uPVC products are known for durability and aesthetic appeal.

3. Cost-effectiveness: uPVC doors and windows are usually cheaper to install compared to wood or aluminum ones, which makes them more affordable for those looking at their overall life cycle costs.

Challenges in the Indian uPVC doors and windows market are:

1. Perception and Awareness: It is essential to dispel misperceptions about the ecological impact of uPVC materials by demonstrating long-term benefits.

2. Competition from Traditional Materials: Nevertheless, traditional materials such as wood and aluminum remain a hindrance even with all the benefits that come with using uPVC including its energy efficiency and longevity.

3. Regulatory Compliance: However, this may result in increased production costs because these standards are continuously being redefined as construction material regulations evolve towards environmentally sustainable practices.

Innovations in material science and manufacturing processes have revolutionized the Indian uPVC doors and windows market by enhancing product durability, thermal insulation, and design flexibility. Advanced uPVC formulations now offer superior resistance to weathering, UV degradation, and impact, prolonging product lifespan and reducing maintenance costs. These advancements have also enabled the production of customizable uPVC profiles that cater to diverse architectural styles and consumer preferences, further driving market adoption and growth.

Indian uPVC Doors and Windows and Their Market In Australia Shares

In this globally competitive market, several key players such as Duroplast, Fenesta, Veka, Encraft, Prominance, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies Indian uPVC doors and windows companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the Indian uPVC doors and windows market companies profiled in this report includes.

• Duroplast

• Fenesta

• Veka

• Encraft

• Prominance

These companies have established themselves as leaders in the Indian uPVC doors and windows market, with extensive product portfolios, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the Indian uPVC doors and windows market are evolving, with the entry of new players and the emergence of innovative Indian uPVC doors and windows market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Indian uPVC Doors and Windows Market by Segment

Major segments of the Indian uPVC doors and windows market experiencing growth include residential construction due to urbanization and increasing demand for energy-efficient solutions, and the commercial sector driven by infrastructure development and renovations in office spaces and retail establishments.

This Indian uPVC doors and windows market report provides a comprehensive analysis of the market's current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including Indian uPVC doors and windows market types, product type and applications. The report offers insights, highlighting the major markets for Indian uPVC doors and windows market and their growth potentials. The study includes trends and forecast for the Indian uPVC doors and windows market by product type, applications, and region as follows:

Indian uPVC doors and windows market by applications [Value ($ Million) from 2018 to 2030]:

• Residential

• Commercial

Indian uPVC doors and windows market by regions [Value ($ Million) from 2018 to 2030]:

• Northern Region

• Eastern Region

• Western Region

• Southern Region

Indian uPVC doors and windows market segmented by products [Value ($ Million) from 2018 to 2030]:

• uPVC Doors

• uPVC Windows

Features of the Indian uPVC Doors and Windows Market

• Market size estimates: Indian uPVC doors and windows market size estimation in terms of volume (M lbs.) and value ($M) shipment.

• Trend and forecast analysis: Indian uPVC doors and windows market trend (2018-2023) and forecast (2024-2030) by regions, products and applications.

• Segmentation analysis: Indian uPVC doors and windows market size by application segments such as residential and commercial and by product segments such as uPVC doors and uPVC windows, both in terms of value shipment.

• Regional analysis: Indian uPVC doors and windows market breakdown by key regions such as Northern Region, Eastern Region, Western Region, and Southern Region.

• Growth opportunities: Analysis on growth opportunities in different applications, products, and regions.

• Strategic analysis: This includes M&A, new product development, competitive landscape, and expansion strategies of Indian uPVC doors and windows market suppliers.

• Emerging applications: Emerging applications of Indian uPVC doors and windows in various markets.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

FAQ

Q1. What is the India uPVC door and window market size?

Answer: The global India uPVC door and window market is expected to reach an estimated $0.3 billion by 2030.

Q2. What is the growth forecast for India uPVC door and window market?

Answer: The global India uPVC door and window market is expected to grow with a CAGR of 7% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the India uPVC door and window market?

Answer: The major drivers for this market are growth in construction activities and increasing awareness towards sustainable, weather resistant, and cost effective construction practices

Q4. What are the major segments for India uPVC door and window market?

Answer: The future of the India uPVC door and window market looks promising with opportunities in the residential, commercial, and industrial and construction sectors.

Q5. What are the emerging trends in India uPVC door and window market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include reducing heating and cooling costs, growing sense of environmental awareness, technological innovations in manufacturing, and urbanization and infrastructure development.

Q6. Who are the key uPVC doors and windows companies?

Answer: Some of the key uPVC doors and windows companies are as follows:

• VEKA

• Rehau

• Koemmerling

• Aluplast

• Dimex

Q7. Which uPVC doors and windows segment will be the largest in future?

Answer: Lucintel forecast that uPVC windows will remain the larger product type segment over the forecast period as these windows are made of this grade of PVC, which are more energy-efficient as compared to wooden or metal frames. Also, they are resistant to chemical erosion.

Q8. In India uPVC door and window market, which region is expected to be the largest in next 5 years?

Answer: APAC will remain the largest region due to rapid urbanization and industrialization, increasing awareness towards uPVC doors and windows, and rising concerns for energy saving in the region.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1. What are some of the most promising, high-growth opportunities for the India uPVC door and window market by product type (UPVC doors and UPVC windows), application (residential buildings, and commercial buildings)?

Q.2. Which segments will grow at a faster pace and why?

Q.3. Which region will grow at a faster pace and why?

Q.4. What are the key factors affecting market dynamics? What are the key challenges and business risks in this market?

Q.5. What are the business risks and competitive threats in this market?

Q.6. What are the emerging trends in this market and the reasons behind them?

Q.7. What are some of the changing demands of customers in the market?Q.8. What are the new developments in the market? Which companies are leading these developments?

Q.9. Who are the major players in this market? What strategic initiatives are key players pursuing for business growth?

Q.10. What are some of the competing products in this market and how big of a threat do they pose for loss of market share by material or product substitution?

Q.11. What M&A activity has occurred in the last five years and what has its impact been on the industry?

For any questions related to Indian uPVC door and window market or related to uPVC door and window companies, uPVC door and window market size, uPVC door and window market share, door and window analysis, door and window market growth, uPVC door and window market research, write Lucintel analyst at email: helpdesk@lucintel.com we will be glad to get back to you soon.