Indian Plastic Pipe Market Trends and Forecast

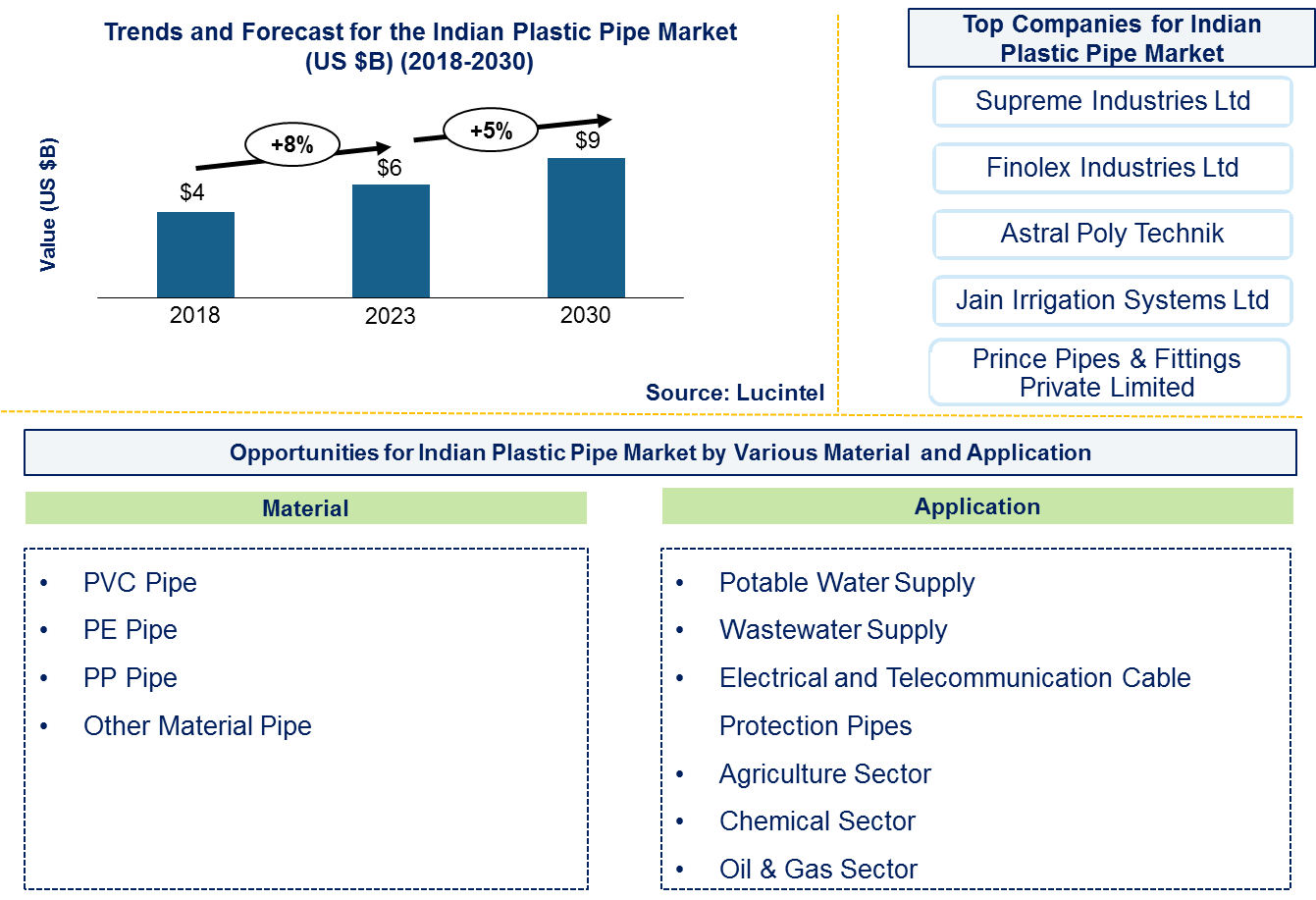

The future of the Indian plastic pipe market looks promising with opportunities in potable water supply, wastewater supply, electrical and telecommunication cable protection, agriculture sector, chemical sector, and oil and gas sector. The Indian plastic pipe market is expected to reach an estimated $9 billion by 2030, and it is forecast to grow at a CAGR of 5% from 2024 to 2030. The major growth drivers for this market are the growth of government infrastructural spending, increasing residential and commercial construction, industrial production, irrigation sector, and replacement of aging pipelines.

Their main raw materials are PVC (Polyvinyl Chloride), CPVC (Chlorinated Polyvinyl Chloride), PE (Polyethylene) and PP (Polypropylene). In terms of their durability and corrosion resistance, PVC pipes are commonly used for water supply and irrigation. CPVC pipes are usually the most suitable for hot water applications as compared to other kinds of plastic pipes while PE and PP pipes work well in more flexible sectors such as agriculture or wastewater management. For different materials type and method of application, India’s plastic pipe market price competitiveness is not the same. This makes these types of tubes commonly used for water supply and irrigation due to their cheaper availability relative to worldwide competitors. The prices of CPVC tubes, which have a higher temperature resistance than those made from other plastics, tend to be slightly higher; HDPE conduits on the other hand offer competitive prices and long-livingness especially in agricultural or drainage purposes.

• Lucintel forecasts that PVC pipes are expected to witness significant growth over the forecast period supported by growing demand in the potable water, wastewater supply and agriculture sector.

• Within the Indian plastic pipe market, potable water supply, wastewater supply, electrical and telecommunication cable protection pipes, agriculture sector, chemical sector, and oil and gas sector are the major application segments. Agriculture sector is expected to remain the largest application. The growth of residential and commercial construction and the growth in infrastructure development especially in the agriculture sector in India are expected to spur growth for this segment over the forecast period.

Country wise Outlook for the Indian Plastic Pipe Market

The Indian plastic pipe market is experiencing significant global growth, buoyed by heightened demand across diverse industries such as construction, agriculture, and infrastructure development. In construction, plastic pipes are integral for plumbing, drainage, and sewerage systems due to their cost-effectiveness and durability. In agriculture, they play a crucial role in irrigation systems, improving water efficiency and crop yield. Below image highlights recent developments by major Indian plastic pipe market producers in key regions: India

Emerging Trends in the Indian Plastic Pipe Market

Emerging trends in the Indian plastic pipe market shaping its future applications and market dynamics:

Rise in Infrastructure Projects: Plastic pipes are preferred for their cost-effectiveness, ease of installation, and durability, making them ideal for water supply, sewage, and drainage systems in urban and rural areas.

Demand for PVC and HDPE Pipes: PVC (Polyvinyl Chloride) and HDPE (High-Density Polyethylene) pipes dominate the Indian market due to their versatility, corrosion resistance, and ability to handle various applications. HDPE pipes, in particular, are gaining popularity for their strength, flexibility, and suitability for underground and above-ground installations.

Focus on Water Conservation and Management: Increasing awareness about water scarcity and the need for efficient water management solutions is driving the adoption of plastic pipes.

Advancements in Manufacturing Technology: Technological advancements in pipe manufacturing processes are improving the quality, durability, and efficiency of plastic pipes. Extrusion technology enhancements allow for the production of pipes with improved strength, resistance to chemicals, and longer service life, meeting diverse application requirements.

Government Initiatives and Regulations: Government policies promoting the use of plastic pipes in infrastructure projects, coupled with regulations ensuring quality standards and environmental sustainability, are influencing market dynamics.

Compliance with Bureau of Indian Standards (BIS) specifications and certifications is crucial for manufacturers to maintain market credibility and consumer trust.

A total of 119 figures / charts and 113 tables are provided in this 306-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments in the Indian Plastic Pipe Market

Recent developments in Indian plastic pipe market which highlights ongoing innovations and advancements across different sectors:

1. Technological Advancements: The use of new technologies in manufacturing to improve the standard and functionality of plastic pipes.

2. Expansion of Product Range: They have also included different sizes, types and forms of pipes that serve various needs within sectors like agriculture, construction and infrastructure.

3. Focus on Sustainability: Encouraging environmental friendly inputs and procedures for production as a way of reducing global environmental impacts due to sustainable development trends.

4. Regulatory Compliance: Complying with strict regulations and certifications, which are set in order to maintain dependable products that can perform well in different areas.

5. Market Consolidation and Growth: This will refer to the process by which market players undergo mergers, acquisitions or strategic partnership deals with an aim of expanding their markets thus improving their competitive advantage.

Strategic Growth Opportunities for Indian Plastic Pipe Market

The Indian plastic pipe market is very dynamic due to its responsiveness to rapid urbanization, government infrastructure projects, technological advancements, and shifting preferences towards durable and cost-effective piping solutions across diverse applications. Some key strategic growth opportunities for this market include:

Urbanization and Infrastructure Development:

• India’s rapid urbanization calls for extended infrastructure development which includes water supply networks, sewage systems, and drainage facilities. These applications favour plastic pipes which are known for being durable, cost-effective and easy to install. Therefore this continuing trend of urbanization provides a major opportunity for market expansion.

Government Initiatives and Water Management Projects:

• Government initiatives such as Jal Jeevan Mission and Smart Cities Mission focus on improving access to safe drinking water and sanitation facilities across urban and rural areas. Plastic pipes play a crucial role in these projects due to their corrosion resistance, longevity, and ability to transport water efficiently. For this reason the increased investments in water management infrastructure create a favorable environment for market growth.

Replacement of Aging Infrastructure:

• Many of IndiaÄX%$%Xs existing water supply and sanitation systems are aging and in need of replacement or upgrading. Plastic pipes offer the best approach to adopt while retrofitting as they have low maintenance requirements besides being corrosion resistant, chemically stable with longer service life compared to conventional materials like metal or concrete.

Technological Advancements in Material Science:

• Innovations in polymer chemistry and manufacturing processes have led to the development of high-performance plastic pipes. Materials such as polyvinyl chloride (PVC), high-density polyethylene (HDPE), and polypropylene (PPR) are increasingly engineered towards meeting stringent performance standards such as pressure resistance, thermal stability, environmental sustainability among others. Manufacturers who invest more towards enhancing material properties through research as well product durability will be better positioned

Expansion in Rural and Agricultural Applications:

• India’s agriculture sector is heavily dependent on irrigation systems for optimal water utilization and crop productivity improvement. Irrigation uses plastic pipes especially; HDPE pipes which are flexible, light weight but cannot easily wear away by abrasives chemicals. There has been growing demand for reliable plastic pipe solutions driven by modernizing agricultural practices that focus on improving water efficiency in rural areas.

Adoption of Green Building Practices:

• Growing awareness of environmental sustainability is driving the adoption of green building practices in IndiaÄX%$%Xs construction sector. In addition, plastics pipes contribute to green building certifications by reducing energy consumption during manufacturing, minimizing environmental impact, and supporting water conservation efforts. Consequently manufacturers who offer products that are eco-friendly and certified can leverage on this trend.

Strategic Partnerships and Market Expansion:

• Pipe manufacturers working with constructors and government organizations can improve market penetration as well as project implementation. Such partnerships could be beneficial by tapping into local know-how, distribution networks, regulatory knowledge for accessing diverse regional markets and infrastructure projects all over the country.

By taking advantage of these strategic growth opportunities, the Indian plastic pipe market can realize its full potential and transform numerous industries through innovative infrastructure solutions and sustainable water management practices

Indian Plastic Pipe Market Driver and Challenges

Indian plastic pipe market plays a pivotal role across industries such as construction, agriculture, and infrastructure development. In construction, plastic pipes are essential for plumbing, drainage, and sewerage systems due to their affordability and durability. In agriculture, they support efficient irrigation systems, enhancing water management and crop productivity. Additionally, in infrastructure projects, plastic pipes are integral for water supply networks, sewage disposal, and industrial applications, highlighting their versatile utility across diverse sectors in India. However, challenges such as production costs underscore the need for strategic solutions to sustain growth and innovation in the Indian plastic pipe market.

The key drivers for the Indian plastic pipe market include:

1. Infrastructure Development: Boosted by rapid urbanization and government efforts to modernize infrastructure, the demand for plastic pipes continues to increase for water supply, sewage systems, and construction projects.

2. Cost-Effectiveness: With respect to the conventional materials like metal, plastic pipes are a cost-effective alternative that reduces total project costs as well as maintenance expenses.

3. Technological Advancements: The use of innovative manufacturing techniques helps in meeting different sector requirements such as product quality, durability, and efficiency.

The challenges facing the Indian plastic pipe market include:

1. Environmental Concerns: This has become a major concern due to environmental issues like plastics pollutions which necessitate sustainable practices in manufacturing and disposal.

2. Quality Control: It is difficult to maintain reliability and safety because market is unorganized with multiple manufacturers who have their own product standards.

3. Competition: For local and international producers alike, this means that they must continuously innovate while strategizing on pricing aspects as well differentiation in the market for them to remain viable.

Innovations in material science and manufacturing processes have driven strong demand in the Indian plastic pipe market, with advancements like composite materials combining the strength of fiberglass with the corrosion resistance of plastic, and innovations in extrusion techniques enhancing pipe performance and longevity. These developments cater to diverse infrastructure needs across IndiaÄX%$%Xs urban and rural sectors.

Indian Plastic Pipe Market Suppliers and their Market Shares

In this globally competitive market, several key players such as Supreme Industries Ltd., Finolex Industries Ltd., Astral Poly Technik Ltd, Jain Irrigation Systems Limited, Prince Pipes & Fittings Private Limited, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies, Indian plastic pipe companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the Indian plastic pipe companies profiled in this report include-

• Supreme Industries Ltd.

• Finolex Industries Ltd.

• Astral Poly Technik Ltd

• Jain Irrigation Systems Limited

• Prince Pipes & Fittings Private Limited

These companies have established themselves as leaders in the Indian plastic pipe industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the Indian plastic pipe are evolving, with the entry of new players and the emergence of innovative indian plastic pipe market technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Indian Plastic Pipe Market by Segment

Major segments experiencing significant growth include irrigation systems and urban water distribution networks. The demand for plastic pipes in irrigation is driven by their cost-effectiveness, ease of installation, and resistance to corrosion, which are crucial factors in IndiaÄX%$%Xs agriculture sector. Urbanization and infrastructure development projects are also driving the growth of plastic pipes in urban water distribution, where their lightweight nature, durability, and ability to withstand harsh environmental conditions make them ideal for delivering potable water and managing wastewater efficiently. Additionally, sectors like telecommunication and industrial applications are increasingly adopting plastic pipes for their versatility and long-term performance benefits, further contributing to market expansion.

This Indian plastic pipe market report provides a comprehensive analysis of the marketÄX%$%Xs current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including Indian plastic pipe market types, material, and application. The report offers insights into regional dynamics, highlighting the major markets for Indian plastic pipe market and their growth potentials. The study includes trends and forecast for the Indian plastic pipe market by material, and application as follows:

Indian Plastic Pipe Market by Material [Value ($ Million) from 2018 to 2030]:

• Polyvinyl Chloride (PVC)

• Poly Ethylene (PE)

• Poly Propylene (PP)

• Others

Indian Plastic Pipe Market by Application [Value ($ Million) from 2018 to 2030]:

• Potable Water Supply

• Wastewater Supply

• Electrical and Telecommunication Cable Protection Pipes

• Agriculture Sector

• Chemical Sector

• Oil and Gas Sector

Features of the Indian Plastic Pipe Market

• Market Size Estimates: Indian plastic pipe market size estimation in terms of value ($M) and volume (KT).

• Trend and Forecast Analysis: Market trends (2016-2021) and forecast (2022-2027) by various segments.

• Segmentation Analysis: Indian plastic pipe market size by various segments, such as application and material.

• Growth Opportunities: Analysis on growth opportunities in different applications and materials for Indian plastic pipe market.

• Strategic Analysis: This includes M&A and competitive landscape for the Indian plastic pipe market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in Indian plastic pipe markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the Indian plastic pipe market size?

Answer: The Indian plastic pipe market is expected to reach an estimated $9 billion by 2030.

Q2. What is the growth forecast for Indian plastic pipe market?

Answer: The plastic pipe market is expected to grow at a CAGR of 5% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the plastic pipe market?

Answer: The major growth drivers for this market are the growth of government infrastructural spending, increasing residential and commercial construction, industrial production, irrigation sector, and replacement of aging pipelines.

Q4. What are the major applications or end use industries for plastic pipes?

Answer: Potable water supply, wastewater supply, electrical and telecommunication cable protection pipes, agriculture sector, chemical sector, and oil and gas sector are the major application segments for plastic pipes in India.

Q5. What are the emerging trends in the Indian plastic pipe market?

Answer: Emerging trends, which have a direct impact on the dynamics of the industry, include rise in infrastructure projects, demand for pvc and hdpe pipes, focus on water conservation and management, government initiatives and regulations, and advancements in manufacturing technology.

Q6. Who are the key Indian plastic pipe companies?

Answer: Some of the key Indian plastic pipe companies are as follows:

• Supreme Industries Ltd.

• Finolex Industries Ltd.

• Astral Poly Technik Ltd.

• Jain Irrigation Systems Limited

• Prince Pipes & Fitting Private Limited

Q7.Which will be the largest material segment of the Indian plastic pipe market in the forecast period?

Answer: Lucintel forecasts that PVC pipes are expected to witness significant growth over the forecast period supported by growing demand in the potable water, wastewater supply and agriculture sector.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

Q.1 What are some of the most promising growth opportunities for the Indian plastic pipe market by material [PVC (Poly Vinyl Chloride) pipes, PE (Poly Ethylene) pipes, PP (Poly Propylene) pipes, and others] and application (potable water supply, wastewater supply, electrical and telecommunication cable protection pipes, agriculture sector, chemical sector, and oil and gas sector)?

Q.2 Which segments will grow at a faster pace and why?

Q.3 What are the key factors affecting market dynamics? What are the drivers and challenges of the Indian plastic pipe market?

Q.4 What are the business risks and threats to the Indian plastic pipe market?

Q.5 What are emerging trends in the Indian plastic pipe market and the reasons behind them?

Q.6 What are some changing demands of customers in the Indian plastic pipe market?

Q.7 What are the new developments in the Indian plastic pipe market? Which companies are leading these developments?

Q.8 Who are the major players in the Indian plastic pipe market? What strategic initiatives are being implemented by key players for business growth?

Q.9 What are some of the competitive products and processes in the Indian plastic pipe market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.10 What M&A activities did take place in the last five years in the Indian plastic pipe market?

For any questions related to Indian plastic pipe market or related to Indian plastic pipe market share, Indian plastic pipe market analysis, Indian plastic pipe market size, and Indian plastic pipe manufacturers, write to Lucintel analysts at helpdesk@lucintel.com. We will be glad to get back to you soon.