In-Vitro Diagnostics Market Trends and Forecast

The technologies of the in-vitro diagnostics market have changed dramatically over the last few years, shifting from traditional immunoassay technology to molecular diagnostics technology. These changes are influenced by advancements in precision medicine, which increasingly employs molecular diagnostics for more accurate and personalized tests. Molecular diagnostics offer increased sensitivity and specificity and the ability to identify a wider array of diseases, including infectious, genetic, and neoplastic diseases at earlier stages. Other contributors to these shifts include the introduction of next-generation sequencing (NGS), PCR-based assays, and CRISPR technologies, among others, making it possible to perform more precise and faster genomic analyses. More targeted therapies and treatment plans are now possible, leading to better patient outcomes. In addition, integration with artificial intelligence and machine learning in platforms for diagnosis enhances the interpretation of data and has supported quicker decision-making in clinics. Molecular diagnostics can play a central role in the future of healthcare as they progress, offering more opportunities for early-stage detection, monitoring, and even effective treatments.

Emerging Trends in the In-Vitro Diagnostics Market

Rapid technological advancements have been prevalent in the in-vitro diagnostics market in recent years. The emerging trends display these innovations and will shape the diagnostics of tomorrow. The key trends listed below include:

• Point-of-Care Testing: The demand for POC testing is growing for quicker diagnosis outside traditional laboratories. This is especially crucial for chronic disease management and infectious diseases. It has improved patient outcomes through faster administration of treatment.

• Molecular Diagnostics: The trend in molecular diagnostics continues to grow with advancements in NGS and PCR technologies, especially where accurate detection in cancer and genetic testing is increasing. It offers increased disease detection and more related treatment.

• Artificial Intelligence (AI) and Automation: AI and machine learning are being integrated into diagnostics to improve accuracy, reduce human error, and speed up processing time. These technologies allow better analysis of data and provide better predictions regarding patient outcomes.

• Lab-on-a-Chip Devices: Lab-on-a-chip technology is becoming more compact, economical, and portable, offering better accessibility and reduced testing costs, especially in remote areas.

• Liquid Biopsy: Liquid biopsy technology is revolutionizing the diagnosis of cancer through the extraction of molecular markers in body fluids non-invasively. This advancement enables early detection and monitoring of treatment effects.

In-vitro diagnostics is undergoing a transformation due to technology trends that are advancing diagnostic speed, accuracy, and personalization. The growing integration of molecular diagnostics with AI-based interventions and point-of-care testing is driving the industry toward more efficient and accessible diagnostic solutions.

In-Vitro Diagnostics Market : Industry Potential, Technological Development, and Compliance Considerations

The in-vitro diagnostics technology landscape itself is highly promising, with key players in molecular diagnostics, point-of-care testing, and AI. These technological shifts promise to create highly personalized, faster, and cheaper solutions for healthcare providers.

• Technology Potential: The potential of in-vitro diagnostics is enormous and is driven by movements in molecular diagnostics, AI, and portable devices, ensuring much more precise testing and more personalized treatment, all leading to positive outcomes for patients.

• Disruption Scale: This market is highly disrupted, with a major shift from traditional diagnostic methods to modern molecular diagnostics and AI-driven solutions. The disruption is evident with advancements in liquid biopsy and point-of-care testing, which are gradually overtaking traditional methods in certain sectors.

• Current Maturity Level of Technology: Many techniques, such as immunoassays and hematology tests, are mature and highly prevalent, while molecular diagnostics and AI integration are developing but are still rapidly being adopted in clinics. These emerging technologies could gain market dominance in the near future.

• Regulatory Compliance: Stricter norms govern in-vitro diagnostics, creating heavy regulatory burdens for more advanced technologies, such as molecular diagnostics. Technologies like AI and point-of-care testing, which are also trending and becoming widely used, will continue to force regulatory bodies to adjust their understanding of how safety and efficacy can be met in the use of these new technologies.

Recent Technological development in In-Vitro Diagnostics Market by Key Players

There has been a tremendous sense of innovation within the IVD technology sector recently, with leaders like Abbott, bioMérieux, Bio-Rad, Siemens Healthineers, and Qiagen at the very forefront of new solutions development. These innovations are driven by rapid advancements in molecular diagnostics, AI, and point-of-care testing, fundamentally changing the shape of diagnostics. Below are some of the most notable recent innovations undertaken by these companies:

• Abbott: Abbott has introduced several innovations in molecular diagnostics, including the Alinity m system to enable fast and accurate PCR testing. Abbott’s forays into point-of-care diagnostics are also aimed at making tests more accessible and faster, especially for infectious diseases like COVID-19, with real-time diagnostics.

• bioMérieux: bioMérieux has made substantial strides in the microbiology space with its VITEK 2 system, which uses advanced algorithms to rapidly identify bacteria and antimicrobial resistance patterns. The company’s continued focus on automation and integrated solutions is enhancing the speed and accuracy of diagnostics, particularly in clinical laboratories.

• Bio-Rad: Bio-Rad has made numerous advancements in clinical diagnostics, including developing its droplet digital PCR (ddPCR) technology for ultra-sensitive nucleic acid detection. Precision medicine requires such technology for early detection of cancer and genetic disorders.

• Siemens Healthineers: Siemens Healthineers leads in AI incorporation into diagnostics. Siemens combines AI in its Atellica Solution, enhancing diagnostic accuracy and decision-making. This AI-driven platform is designed to enhance laboratory operations and clinical outcomes through actionable insights.

• Qiagen: Qiagen has pushed the boundaries of molecular diagnostics with its GeneReader NGS System; these are next-generation sequencing platforms that provide high resolution and detailed genomic analysis. This technology plays a vital role in oncology, enabling precision medicine and guiding treatment by recognizing genetic mutations.

These innovations from major players such as Abbott, bioMérieux, Bio-Rad, Siemens Healthineers, and Qiagen accelerate the transition towards more efficient, accurate, and accessible in-vitro diagnostic technologies. The rapid changes focus on molecular diagnostics, AI, and point-of-care solutions, transforming the market and leading to faster, more personalized treatments.

In-Vitro Diagnostics Market Driver and Challenges

The in-vitro diagnostics market has various drivers and challenges influencing its development and adoption. Understanding these factors helps with the appraisal of the future direction of the market, where innovation is rapidly advancing to meet new healthcare needs.

The driving factors for the in-vitro diagnostics market are:

• Advances in Molecular Diagnostics: The increasing use of molecular diagnostics like PCR and NGS drives the market due to their ability to provide accurate and personalized test results for many diseases.

• Rise in Point-of-Care Testing: The upsurge in demand for point-of-care testing solutions offering rapid diagnostics is transforming the market. These tests are vital during emergencies or when medical services are scarce.

• Aging Populations: As the global population ages, the need for diagnosis increases, particularly in chronic diseases and age-related conditions that are stable and need constant check-ups.

• AI-based Technologies in Diagnostics: The integration of AI into diagnostic processes increases efficiency, accuracy, and speed in yielding results, thus enabling better clinical decision-making and operational efficiency.

• Personalized Medicine: Personalized medicine and advanced diagnostic technologies boost the development of tailored treatment options for specific patient profiles, thanks to tests developed based on individual patient profiles.

Challenges in the in-vitro diagnostics market are:

• Regulatory Barriers: In-vitro diagnostics face very stringent regulatory requirements, especially for newer technologies such as molecular diagnostics and AI, which can slow time-to-market and increase development costs.

• High Innovation Costs: Advanced technologies, such as NGS and advanced molecular diagnostic tools, are not affordable and are confined to resource-limited settings, thereby raising the cost of care.

• Integration Challenges: It is difficult to integrate new technologies with existing diagnostic systems and healthcare infrastructures, particularly in low-resource settings, which slows down their adoption.

• Security of Patient Data: With the growing adoption of AI and data-driven diagnostics, there is a huge concern regarding patient data security and confidentiality, especially in the context of cloud-based diagnostic systems.

• Training of Healthcare Staff: With advancing technology, health professionals require continuous training in the application of new diagnostic tools, which can pose a challenge in consistent adoption.

The drivers and challenges of the in-vitro diagnostics market shape its growth and development. Technological leadership, especially in molecular diagnostics and AI, continues to spur innovation. However, high costs and regulatory hurdles, as well as the challenge of data security, remain major challenges that need to be overcome for widespread acceptance. These factors shape the trend of the market.

List of In-Vitro Diagnostics Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies, in-vitro diagnostics companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the in-vitro diagnostics companies profiled in this report include.

• Abbott

• bioMérieux

• Bio-Rad

• Siemens Healthineers

• Qiagen

In-Vitro Diagnostics Market by Technology

• Technology Readiness: Technologies like immunoassay and clinical chemistry are highly mature and are widely applied in clinics for routine diagnostics. Hematology and coagulation technologies are well-established but still witnessing advancements toward increased automation and precision. Molecular diagnostics is growing rapidly, but it is still evolving with significant innovation in next-generation sequencing and PCR technologies. Advances in microbiology technologies include an increased adoption of automated systems for pathogen detection in infectious disease testing. While at different stages of maturity, all these technologies face regulatory challenges and competition, and their readiness will be driven by the ongoing pressure to provide more efficient, accurate, and accessible solutions for diagnostics.

• Competitive Intensity and Regulation Compliance: The competitive intensity in the in-vitro diagnostics market is very high, and key players focus on advanced technologies related to immunoassay, hematology, molecular diagnostics, and more to ensure market leadership. Abbott, Roche, and Siemens Healthineers are constantly innovating and enriching their product lines. The industry is highly regulated due to its impact on healthcare, so regulatory compliance becomes essential for these technologies. Molecular diagnostics and point-of-care solutions are strictly regulated in terms of safety and efficacy. In contrast, established standards for immunoassay and clinical chemistry facilitate these technologies, but newer technologies have to grapple with complexly regulated processes, making competition stiffer.

• Disruption Potential: The in-vitro diagnostics market is experiencing massive disruption through advancements across several technologies such as immunoassay, hematology, clinical chemistry, molecular diagnostics, coagulation, and microbiology. Molecular diagnostics, for example, transform early disease detection and personalized medicine by offering more specific, faster tests. Immunoassays continue to better detect biomarkers, whereas hematology and coagulation technologies are shifting toward higher-throughput, automated systems for increased accuracy with fewer errors in human judgment. Clinical chemistry and microbiology products, including point-of-care testing, significantly enable faster diagnostics, particularly in infectious disease management, thereby disrupting traditional diagnostic workflows and establishing new pathways to patient care.

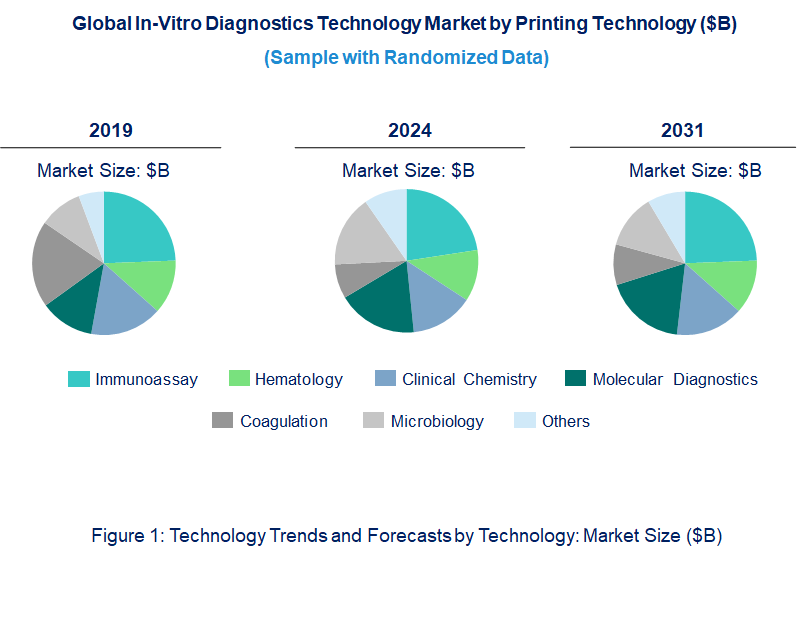

In-Vitro Diagnostics Market Trend and Forecast by Technology [Value from 2019 to 2031]:

• Immunoassay

• Hematology

• Clinical Chemistry

• Molecular Diagnostics

• Coagulation

• Microbiology

• Others

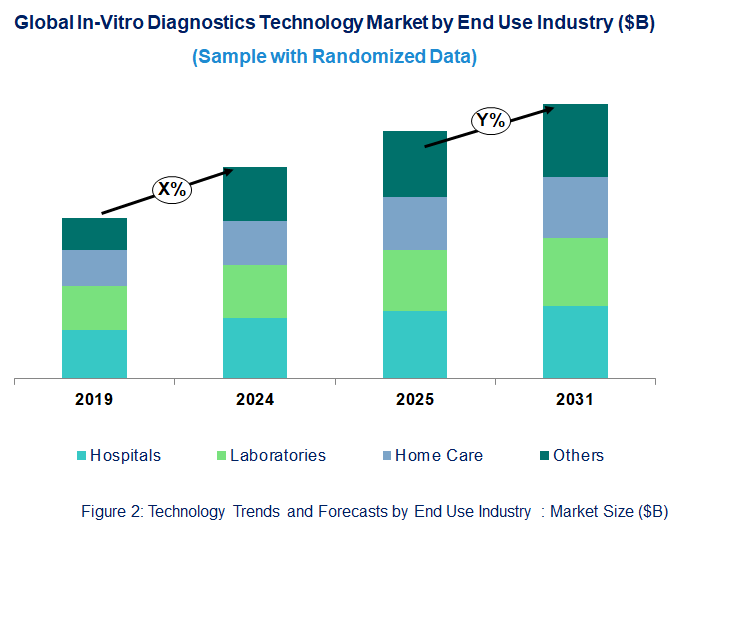

In-Vitro Diagnostics Market Trend and Forecast by End Use Industry [Value from 2019 to 2031]:

• Hospitals

• Laboratories

• Home Care

• Others

In-Vitro Diagnostics Market by Region [Value from 2019 to 2031]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the In-Vitro Diagnostics Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global In-Vitro Diagnostics Market

Market Size Estimates: In-vitro diagnostics market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Technology trends in the global in-vitro diagnostics market size by various segments, such as technology and end use industry in terms of value and volume shipments.

Regional Analysis: Technology trends in the global in-vitro diagnostics market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different end use industries, technologies, and regions for technology trends in the global in-vitro diagnostics market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global in-vitro diagnostics market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global in-vitro diagnostics market by technology (immunoassay, hematology, clinical chemistry, molecular diagnostics, coagulation, microbiology, and others), end use industry (hospitals, laboratories, home care, and others), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different technologies? What are the drivers and challenges of these technologies in the global in-vitro diagnostics market?

Q.5. What are the business risks and threats to the technology trends in the global in-vitro diagnostics market?

Q.6. What are the emerging trends in these technologies in the global in-vitro diagnostics market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global in-vitro diagnostics market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global in-vitro diagnostics market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this in-vitro diagnostics technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global in-vitro diagnostics market?