Filled Thermoplastics in the European Consumer Goods Market Trends and Forecast

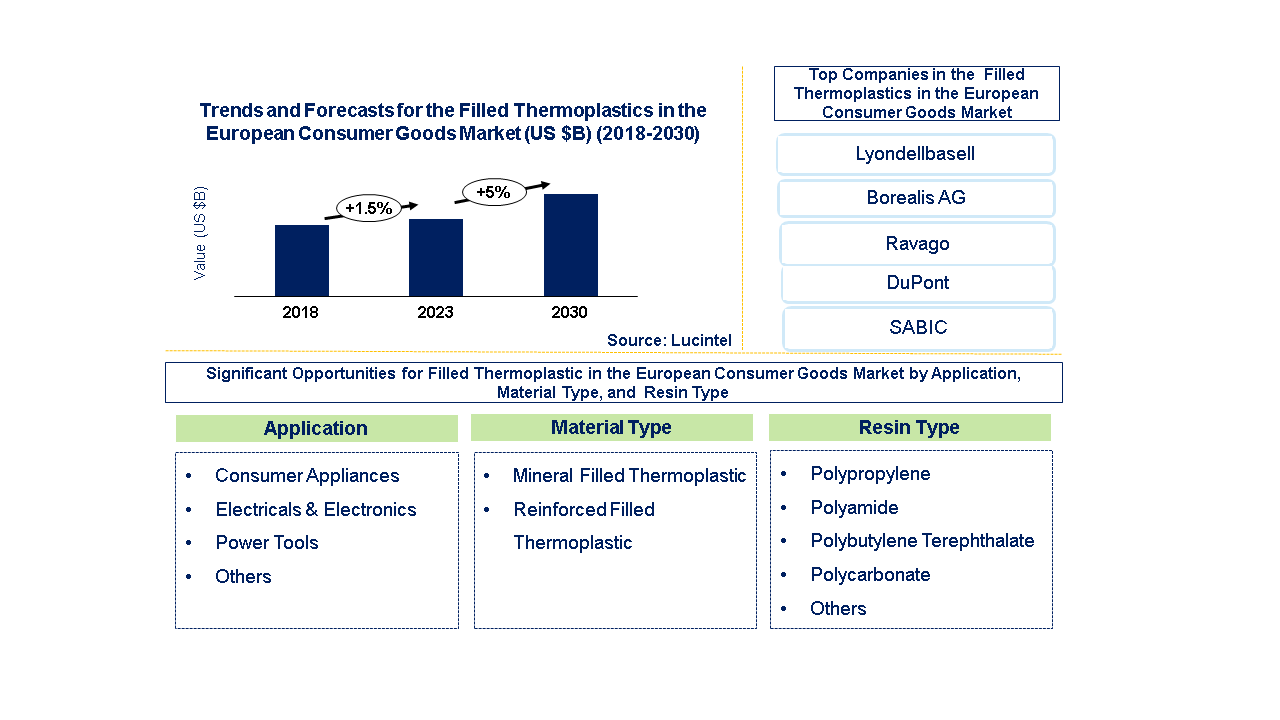

Lucintel finds that the future of the filled thermoplastics in the European consumer goods intermediate material market looks promising with opportunities in the consumer appliances, electrical & electronics, and power tools markets. The filled thermoplastic market is expected to reach an estimated $3 billion by 2030 with a CAGR of 5% from 2023 to 2030. The major drivers for this market are growing demand for consumer goods, increasing use of plastic components to reduce the part weight, shorter molding cycle times and an infinite shelf life compared to thermosets, and replacement of traditional materials

Filled thermoplastics in the European consumer goods market typically use a variety of raw materials such as polypropylene (PP), polyethylene (PE), polycarbonate (PC), nylon, and ABS (acrylonitrile butadiene styrene), combined with fillers like glass fibers, carbon fibers, minerals (like talc or calcium carbonate), and additives (such as flame retardants or impact modifiers). Filled thermoplastics come with different prices depending on the formulation, quality, and market situation; however, they are always priced fairly when compared to traditional materials such as metals or unfilled plastics because of their lightweightness, durability and customization properties.

• Lucintel forecasts that electrical & electronics filled thermoplastic composites in European consumer goods will remain the largest application over the forecast period due to the mechanical properties like strength, heat resistance, and low water absorption. Consumer appliances is expected to witness highest growth over the forecast period.

• Polypropylene resin based filled thermoplastics will remain the largest segment and it is expected to witness the highest growth over the forecast period due to the growing use of lightweight materials and comparatively lower cost than other thermoplastic resins.

Country wise Outlook for the Filled Thermoplastics Companies in the European Consumer Goods Market

The filled thermoplastics in the European consumer goods market is witnessing substantial growth globally, driven by increased demand from various industries such as consumer appliances, electrical and electronics, power tools, and others. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major filled thermoplastics in the European consumer goods producers in key regions: the UK, Germany, and France.

Emerging Trends in the Filled Thermoplastics in the European Consumer Goods Market

Emerging trends in the filled thermoplastics in the European consumer goods market shaping its future applications and market dynamics:

• Development of Advanced Composite Materials: Innovations in filled thermoplastics are leading to the development of superior composite materials having distinct features such as including toughness, stiffness and reduced weight. These materials are increasingly used in high-performance applications across automotive, aerospace, and consumer electronics sectors.

• Adoption of 3D Printing and Additive Manufacturing: The adoption of 3D printing and additive manufacturing technologies is driving innovation in filled thermoplastics. Companies are using these technologies so as to create intricate shapes and customized parts that provide design flexibility and fast prototyping capabilities.

• Increasing Use of Bio-based and Recycled Materials: Increasing emphasis on sustainability is prompting the use of bio-based fillers and recycled polymers in filled thermoplastics. Innovations in material sourcing and processing techniques are allowing for eco-friendly alternatives that minimize environmental impact whilst retaining performance standards

• Smart Materials and IoT Integration: Filled thermoplastics are being integrated with smart technologies and IoT devices enabling functionalities such as sensing, monitoring, data transmission among others. These smart materials find applications in consumer electronics, healthcare devices, smart packaging solutions etc.

• Innovations in Surface Modification and Coatings: Innovations in surface treatments, coatings, functional additives have improved the performance durability of filled thermoplastics. Various technological advancements like scratch resistance properties UV stability anti-microbial properties have expanded its application into consumer goods sector healthcare industries etc.

These trends underline ongoing developments occurring within Europe’s field for filled thermoplastic which are technologically driven ones specialized market needs related to functional demands or otherwise environmentally friendly goals. Other avenues still exist which firms as well as scientists may take so as to improve the efficiency adaptability plus greenness of this plastic range concerning consumers’ goods sector.

A total of 65 figures / charts and 67 tables are provided in this 241-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Filled Thermoplastics in the European Consumer Goods Market

Recent developments in filled thermoplastics in the European consumer goods by various companies highlight ongoing innovations and advancements across different sectors:

• Innovative Material Formulations: Companies are increasingly concentrating on the development of filled thermoplastics having improved mechanical properties, durability and aspects of sustainability through advanced formulations. This entails utilization of recycled materials as well as bio-based fillers to accommodate emerging environmental legislations and consumer preferences.

• Customized Solutions: Filled thermoplastics customization is a market trend where players attempt at meeting specific needs of various industries like automotive, electronics, packaging or healthcare. Consequently, this customization should enable the optimization of material properties in order to achieve desirable performance metrics such as light weight, resistance to heat or strength against impacts.

• Technological Integration: The application of filled thermoplastics together with other modern manufacturing techniques like 3D printing and additive manufacturing has made it possible for production of intricate geometries and innovative designs. Due to this reason, its suitability is more apparent in fast prototyping situations and instances where low volume production is needed across a number of consumer goods sectors.

• Sustainability Initiatives: European firms are proactively engaged in endeavors aimed at developing sustainable filled thermoplastics by establishing closed-loop recycling systems as well as minimizing the environmental impact associated with its manufacture. Therefore, there have been initiatives that seek to increase the recyclability, reduce waste generation and also minimize energy consumption right from product’s birth to death.

• Smart Applications: For instance IoT devices used in smart applications within consumer goods use filled thermoplastics which include wearable technology and smart packaging solutions. These are designed to fit seamlessly with elements like electronic components sensors and connectivity features thus enhancing their functional value and user-friendliness.

Strategic Growth Opportunities for Filled Thermoplastics in the European Consumer Goods Market

In Europe, the filled thermoplastic consumer goods market provides valuable growth strategies because of several factors and industrial uses. Below are key growth areas outlined in bullet form:

Sustainability and Regulatory Compliance:

• Market Demand: Increased consumer awareness and strict environmental regulations have generated demand for sustainable materials in consumer goods.

• Opportunity: Filled thermoplastics that meet recycling requirements, reduced carbon footprint, adherence to European Union directives like REACH etc satisfy the need for eco-friendly products from the market.

Automotive Industry Applications:

• Industry Requirements: The lightweight features as well as design flexibility make filled thermoplastics essential in automotive interior and exterior components.

• Opportunity: Growth in electric vehicles (EVs) and demand for fuel-efficient cars create opportunities for thermoplastics that enhance vehicle performance, safety, and aesthetics.

Advanced Packaging Solutions:

• Market Demand: Filled thermoplastics play a vital role in packaging food, cosmetics, pharmaceuticals and luxury items by offering barrier properties and design versatility.

• Opportunity: Innovations in packaging materials that improve shelf life, product protection and visual appeal align with consumer preferences for convenience and sustainability.

Electronics and Electrical Applications:

• Industry Needs: Filled thermoplastics are used to manufacture electronic housings, connectors, as well as casings of consumer electronics appliances and telecommunication devices.

• Opportunity: Growing demand for smart devices/IOT products/energy efficient appliances necessitate enhanced electrical properties/thermal management /durability among other requirements made upon these types of plastics by rising customers’ demands.

Filled Thermoplastics in the European Consumer Goods Market Drivers and Challenges

The European consumer goods market for filled thermoplastics is driven by increasing demand for lightweight, durable materials in sectors like automotive parts and electronics. These materials offer enhanced mechanical properties and cost-effectiveness compared to traditional alternatives. However, challenges such as regulatory compliance with environmental standards and fluctuating raw material costs pose significant barriers. Navigating these dynamics requires innovation in material formulations and strategic partnerships to meet evolving consumer expectations for sustainability and performance. Balancing these factors is crucial for stakeholders aiming to capitalize on the growth potential of filled thermoplastics in Europe's competitive consumer goods sector

The key drivers for the Filled Thermoplastics in the European Consumer Goods Market

1. Design Flexibility and Customization: Filled thermoplastics make for flexibility and customization in the designs of electronic, automotive, and household items.

2. Cost savings: This material is an economical alternative to traditional materials such as metal and ceramics. As a result, it reduces production costs hence improves competitiveness.

3. Environmentally friendly products: Regulatory pressure and consumer demand are shifting towards eco-friendly goods made from filled thermoplastic that are recycled or contain compostable ingredients.

4. Improved performance: Improved properties like durability, impact resistance and thermal stability of filled thermoplastics due to advancements in material science results in better performance requirements that have been set for consumer applications.

5. Demand & Growth in end use sectors : Demand propelled by light weight nature coupled with functional advantages through sectors like packaging, electronics and healthcare sustains the growth of filled thermoplastics market.

The key challenges for the Filled Thermoplastics in the European Consumer Goods Market

1. Material Selection and Compatibility: The quest for the right formulation of filled thermoplastic that will strike a balance between price, functionality and environmental friendliness is complex and may require extensive experimentation and expertise.

2. Quality Assurance and Consistency: It is essential to maintain consistency in the quality of materials supplied and their performance across different production batches to ensure that products remain reliable enough to satisfy consumers in a competitive European market.

3. Regulatory Compliance: Manufacturers using filled thermoplastics have to deal with the difficulties posed by strict regulations established by the EU which touch on material safety, environmental impact, recycling needs among others.

4. Competition from Alternative Materials: In order for companies operating in this market segment not be outcompeted by other alternative materials such as metals, glass or other plastics having different characteristics and functionalities continuous innovation coupled with changes are prerequisite.

5. Market Fragmentation: The Europe consumer goods market is diverse with different consumer preferences as well as regulatory environments among various countries calling for customized strategies for entry and growth.

Innovative advancements in filled thermoplastics continue to shape the European consumer goods market, driving efficiency and sustainability. However, the evolving landscape also presents challenges in maintaining regulatory compliance and managing material costs. Successfully navigating these complexities demands continuous innovation and strategic partnerships, ensuring filled thermoplastics meet both environmental standards and consumer expectations for quality and performance.

Filled Thermoplastics in the European Consumer Goods Market

Suppliers and Their Market Shares

In this globally competitive market, several key players such as LyondellBasell, Borealis AG, Ravago, DuPont etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players Contact Us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies filled thermoplastics in the European consumer goods companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the filled thermoplastics in the European consumer goods companies profiled in this report includes.

• LyondellBasell

• Borealis AG

• Ravago

• DuPont

• DSM

• BASF

• Solvay

These companies have established themselves as leaders in the filled thermoplastics in the European consumer goods industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the filled thermoplastics in the European consumer goods market are evolving, with the entry of new players and the emergence of innovative technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Filled Thermoplastics Companies in the European Consumer Goods

Market by Segment

In the European market for consumer goods, a number of leading segments have seen significant expansion in filled thermoplastics. They are being used increasingly in the automotive sector to make lighter materials for vehicle interiors, exteriors and components. In electronics and electrical appliances, filled thermoplastics are also growing as a result of such dramatic innovations and customer demands for strong yet light objects like covers, connectors and structural parts. Packaging applications have also grown with filled thermoplastics that offer them barrier properties and sustainability benefits for food and beverage packaging. In addition, health care industry’s use of filled thermoplastics is increasing in terms of biocompatibility and sterilizability to spur innovation in medical equipment and devices sectors. Taken together these sectors are expected to grow further as new material formulations improve with increasing use across various industries that manufacture consumer goods throughout Europe.

Filled Thermoplastic Composites in European Consumer Goods Market by Material Type [Value ($M) and Volume (M lbs) Shipment Analysis for 2018 – 2030]:

• Mineral Filled Thermoplastic

• Reinforced Thermoplasti

Filled Thermoplastics in the European Consumer Goods Market by Application [Value ($M) and Volume (M lbs) Shipment Analysis for 2018 – 2030]:

• Mineral Filled Thermoplastic

o Consumer Appliances

Refrigerators

Washing Machines

Microwaves

Dishwashers

Other Appliances

o Electrical & Electronics

Circuit Breakers

Consumer Electronics

Other Electrical & Electronics

o Power Tools

o Other Applications

• Reinforced Filled Thermoplastic

o Consumer Appliances

Refrigerators

Washing Machines

Microwaves

Dishwashers

Other Appliances

o Electrical & Electronics

Circuit Breakers

Consumer Electronics

Other Electrical & Electronics

o Power Tools

o Other Applications

Filled Thermoplastics in the European Consumer Goods Market by Resin Type [Value ($M) and Volume (M lbs) Shipment analysis for 2018 – 2030]:

• Polypropylene

• Polyamide

• Polybutylene Terephthalate (PBT)

• Polycarbonate

• Others

Features of Filled Thermoplastics in the European Consumer Goods Market

• Market Size Estimates: Filled thermoplastics in the European consumer goods market size estimation in terms of value ($M)and volume (M lbs)

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments.

• Segmentation Analysis: Market size by material type, application and resin type

• Growth Opportunities: Analysis of growth opportunities in different material type, application and resin type for the filled thermoplastics in the European consumer goods market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the filled thermoplastics in the European consumer goods market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in filled thermoplastics in the European consumer goods or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ_

Q1. What is the filled thermoplastic composite in European consumer goods market size?

Answer: The filled thermoplastic composites in European consumer goods market is expected to reach an estimated $3 billion by 2030.

Q2. What is the growth forecast for filled thermoplastic composites in European consumer goods market?

Answer: The filled thermoplastic composites in European consumer goods market is expected to grow at a CAGR of 5% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the filled thermoplastic composites in European consumer goods market?

Answer: The major drivers for this market are growing demand for consumer goods, increasing use of plastic components to reduce the part weight, shorter molding cycle times and an infinite shelf life compared to thermosets, and replacement of traditional materials.

Q4. What are the major applications or end use industries for thermoplastic resin in automotive composites?

Answer: Electrical & electronics and consumer appliances are the major applications for thermoplastic composites in the European consumer goods market.

Q5. What are the emerging trends in filled thermoplastic composites in European consumer goods market?

Answer: Emerging trends, which have a direct impact on the dynamics of the European consumer goods industry, include development of advanced composite materials, adoption of 3D printing and additive manufacturing, increasing use of bio based and recycled materials, smart materials and IOT integration, and innovations in surface modification and coatings..

Q6. Who are the key filled thermoplastic composites in European consumer goods companies?

Answer: Some of the key filled thermoplastic composites in European consumer goods companies are as follows:

• LyondellBasel

• Borealis AG

• Ravago

• Toray Industries Inc.

• DuPont

• DSM

• Solvay

• BASF SE

• SABIC

• Celanese

• LANXESS

• TenCate

Q7.Which filled thermoplastic composites in European consumer goods material segment will be the largest in future?

Answer: Lucintel forecasts that polypropylene resin based filled thermoplastics will remain the largest segment and it is expected to witness the highest growth over the forecast period due to the growing use of lightweight materials and comparatively lower cost than other thermoplastic resins.

Q8. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost

This report answers following 10 key questions

Q.1 What are some of the most promising potential, high growth opportunities for the global filled thermoplastics in the European consumer goods market by application (consumer appliances, electrical & electronics, power tools, and others), material type (mineral filled, and fibers), and resin type (polypropylene, polyamide, polybutylene terephthalate (PBT), polycarbonate, and others)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.4 What are the business risks and threats to the market?

Q.5 What are the emerging trends in this market and the reasons behind them?

Q.6 What are the changing demands of customers in the market?

Q.7 What are the new developments in the market? Which companies are leading these developments?

Q.8 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.9 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.10 What M & A activities have taken place in the last 5 years in this market?