Fiber Sizing Market Trends and Forecast

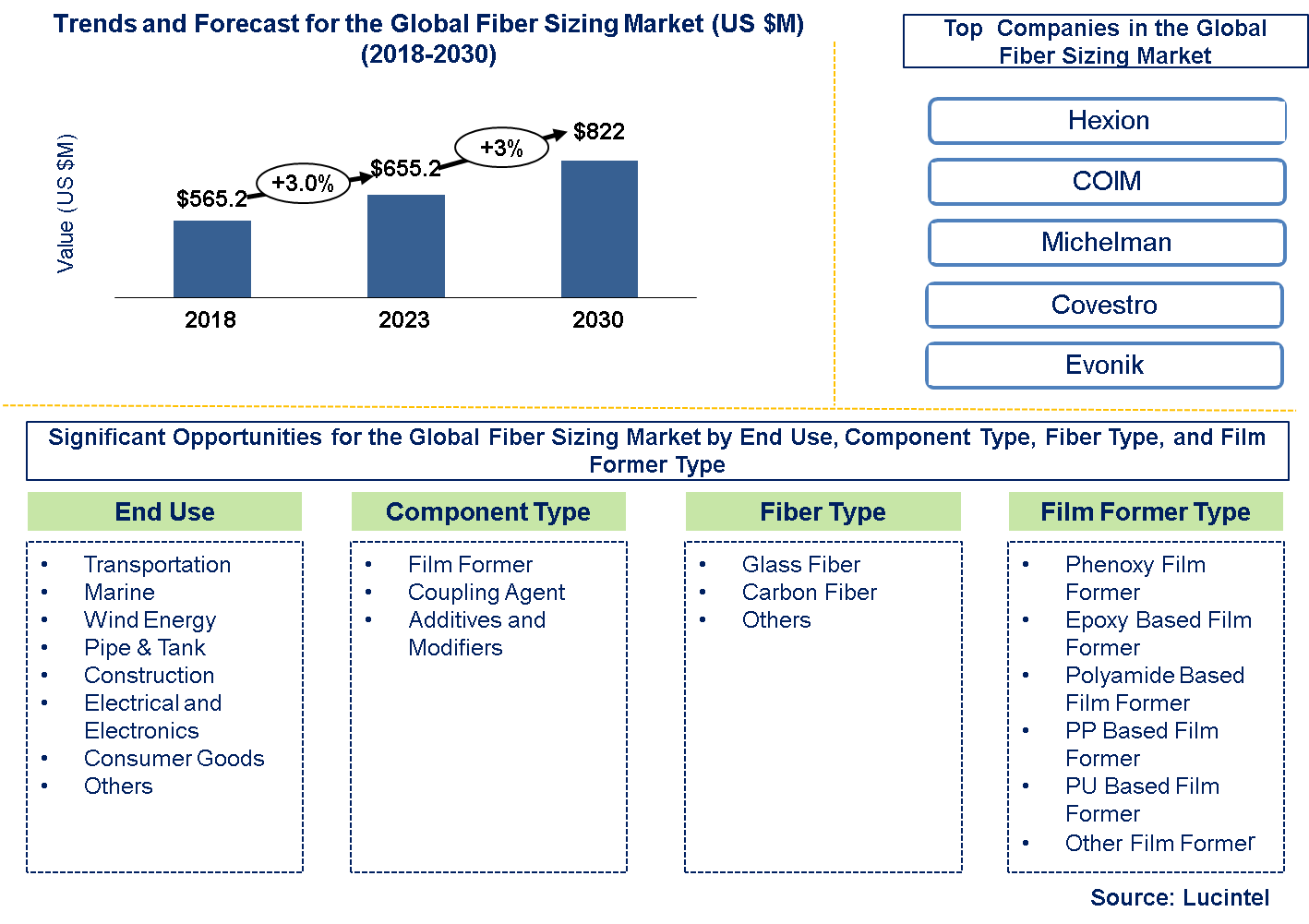

Lucintel finds that the future of the global fiber sizing market looks promising with opportunities in various transportation, pipe and tank, construction, electrical and electronics, wind energy, consumer goods, and marine end uses. The global fiber sizing market is expected to reach an estimated $822 million by 2030 with a CAGR of 3% 2023 to 2030. The major drivers for this market are increasing demand for reinforced composite materials and the performance benefits of sizing in fiber.

Fiber sizing is made up of raw materials like resins (epoxy, polyester), coupling agents (silanes) and additives. These components are essential in improving adherence between fibers as well as the matrix ingredients. The cost of fiber sizing depends on the prices of raw materials, complexity of formulation as well as dynamics of demand in the market. Normally, competitive pricing within the fiber sizing sector is influenced by economies of scale, technological improvements and particular performance specifications for diverse composite applications.

• Lucintel forecasts that transportation will remain the largest end use industry by value and volume. Wind Energy is expected to witness the highest growth over the forecast period due to the growth in the demand for lightweight and high performance materials.

• Glass fiber will remain the largest segment by value and volume. Sizing for carbon fiber is expected to witness the highest growth over the forecast period due to the growing demand for carbon fiber in different end uses.

• Asia Pacific will remain the largest market for fiber sizing due to the presence of major glass and carbon fiber manufacturers in the region. ROW is expected to witness the highest growth rate over the forecast period due to increasing demand for composites.

Country wise Outlook for the Fiber Sizing Market

The fiber sizing market is witnessing substantial growth globally, driven by increased demand from various industries such as transportation, pipe and tank, construction, electrical and electronics, wind energy, consumer goods, marine, and others. Major players in the market are expanding their operations and forming strategic partnerships to strengthen their positions. Below image highlights recent developments by major fiber sizing producers in key regions: the USA, Germany, China, India, and Brazil.

Emerging Trends in the Fiber Sizing Market

Emerging trends in the fiber sizing market shaping its future applications and market dynamics:

• Sustainability Focus: The need for sustainable products from consumers and regulatory demands has resulted in a noticeable trend towards sustainable fiber sizing methods. Companies are investing money on recyclable and bio-based formulations to lessen their influence on the environment.

• Advanced Materials: The enhancement of high-functioning fiber-sizing agents is enabled by rapid advancements in polymer science and nanotechnology. Such improvements boost the functionality, strength as well as durability of composite materials used in a variety of fields such as construction, aerospace and automotive.

• Customization and Specialization: More producers are increasingly offering special fiber size options tailored to some market needs for materials with performance characteristics optimized for different working environments.

• Focus on Lightweight: Development of fiber sizing solutions which help bring down weight while still maintaining strength and performance is becoming more significant due to increased demands for lighter materials in automobile and aerospace industries.

• Global Expansion and Partnerships: Businesses are using joint ventures, acquisitions, and strategic alliances to increase their market share. Using this strategy helps enter new markets, utilize regional knowledge, and fuse complementary technology for better product mix.

A total of 100 figures / charts and 130 tables are provided in this 190-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments by the Fiber Sizing Suppliers

Recent developments in fiber sizing market by various companies highlight ongoing innovations and advancements across different sectors:

• Innovation in Sustainable Solutions: Companies are focusing on sustainability in creating bio-based fiber sizing agents that are friendly to the environment and meet the regulations of the market.

• Technological Advancements: The use of nanotechnology and innovative materials in fiber sizing formulations is what makes firms stand out, as they seek for better qualities like strength, hardiness and compatibility with other fibers

• Market Expansion Strategies: To gain entrance into the global market for fiber sizing, businesses are making strategic investments and partnerships; this means tapping into growth opportunities in industries such as automotive, aerospace, and construction sectors.

• Mergers and Acquisitions: In order to improve their market standing by being leaders in innovation, there is a tendency to consolidate through mergers or acquire highly specialized companies dealing with fiber-sizing technology among other strategic alliances.

Strategic Growth Opportunities for Fiber Sizing Market

• Expansion in Automotive and Aerospace: The extensive application lightweight materials in automobile and aircraft industries present possibility of advanced fiber sizing solutions.

• Focus on Sustainable Solutions: Manufacturing environments friendly formulations for fiber that are derived from biological sources to conform to sustainability commitments and statutory specifications.

• Technological Advancements: Investment in research to improve such characteristics of performance as adhesiveness, wear resistance, ability to stick on different fiber and resin types.

• Global Market Penetration: Entering into new markets in emerging economies of the world with increasing industrialization and infrastructure development.

• Creating Partnerships and Cooperation Agreement: Enlisting the support of other stakeholders including fiber manufacturers, composite makers as well as end-users for partnering on product customization initiatives as well as widening market base.

Fiber Sizing Market Drivers and Challenges

The fiber sizing market is driven by a confluence of factors, which underpin its pivotal role in the composites industry. The growing demand for light weight and high-performance materials across sectors such as automotive, aerospace and construction has further pushed for the need of advanced fiber sizing solutions. In addition, search for eco-friendly biomaterials and new technologies have driven the development of bio-based or environmentally friendly products. Nonetheless, within these opportunities, there are complexities like regulatory compliance concerns; technical problems associated with material integration; need to remain price competitive amid changing market situations.

The key drivers for the Fiber Sizing market

• Increasing Demand in Composite Applications: Growing use of composites in industries like automotive, aerospace, construction, and wind energy drives demand for effective fiber sizing solutions.

• Advancements in Material Science: Advances in material science continuously introduce novel fibers and resins systems thus need an improvement of technology sustaining its adhesion as well as its performance at large.

• Focus on Lightweight and High-Performance Materials: Demand for lightweight materials with enhanced strength and durability fuels innovation in fiber sizing for composites.

• Environmental Regulations: The transition towards sustainable alternatives has led to a rise in the production of fiber sizing compounds made from biodegradable materials such as biomass or recycled organic products.

• Technological Integration: Increasing adoption of automation and digitalization in manufacturing processes enhances precision and efficiency in applying fiber sizing agents.

The key challenges for the Fiber Sizing market

• Complexity of Composite Materials: Fiber type variations, differing resin systems and application demands make it challenging to develop a universal fiber-sizing solution.

• Cost and Price Competitiveness: Pressure to maintain cost-effectiveness amid fluctuating raw material costs and competitive pricing in the global market.

• Regulatory Compliance: Demand for compliance with strict environmental rules and health standards for chemical formulations as well as manufacturing methods.

• Technical Requirements and Performance Standards: Need for continuous innovation to meet evolving industry standards and performance expectations.

• Supply Chain Dynamics: Vulnerability to disruptions in raw material supply chains and logistical challenges affecting production and distribution.

In conclusion, the fiber sizing market is in the middle of innovation revolution, eco-conservation and strict performance criteria. This means that more fiber agents will be required because lightweight and high-strength materials remain a priority for most industrial segments. The ability to address regulatory issues, technological challenges and maintaining smooth supply chain are some of the factors that stakeholders who want to exploit growth opportunities in this dynamic market must keep in mind. It is through embracing change, creating strategic alliances and striving for sustainable entrepreneurship practices that can help manufacturers maneuver the complexities presented by the ever changing fiber sizing industry.

Fiber Sizing Suppliers and Their Market Shares

In this globally competitive market, several key players such as Hexion, COIM, Michelman, Covestro, Polymer Chemistry Innovation Inc., Alliancys, and Evonik etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players Contact Us. If you wish to deep dive in competitive positioning of these players then you can look into our other syndicated market report on “Fiber Sizing Leadership Report".

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies fiber sizing companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the fiber sizing companies profiled in this report include.

• Hexion

• COIM

• Michelman

• Covestro

• Polymer Chemistry Innovation Inc.

• Alliancys

• Evonik

These companies have established themselves as leaders in the fiber sizing industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the fiber sizing market are evolving, with the entry of new players and the emergence of innovative fiber sizing technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Fiber Sizing Market by Segment

There is a great development in the fiber sizing market in many key areas. First, there is an observable move towards bio-based agents that are used for sizing fibers and it is driven by environmental concerns and need for green materials. Secondly, high-performance sizes are making an impact, especially in industries where fibers have to be improved, like aerospace and automotive. Thirdly, nanotechnology has led to nano scale size development maximizing fiber adhesion and performance even at molecular scale. In addition, smart-sizing formulations containing functionalities such as self-healing or self-cleaning are emerging as new approaches. Lastly, sizing now includes functional additives like antimicrobial agents or conductive materials catering to different markets with different needs.

Fiber Sizing Market by End Use [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Transportation

• Pipe and Tank

• Construction

• Electrical & Electronics

• Wind Energy

• Consumer Goods

• Marine

• Others

Fiber Sizing Market by Component Type [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Film Former

• Coupling Agent

• Additives and Modifiers

Fiber Sizing Market by Fiber Type [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Glass Fiber

• Carbon Fiber

• Others

Fiber Sizing Market by Film Former Type [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• Phenoxy Film Former

• Epoxy Based Film Former

• Polyamide Based Film Former

• PP Based Film Former

• Polyurethane Based Film Former

• Other Film Formers

Fiber Sizing Market by Region [Value ($M) and Volume (M lbs) Analysis for 2018 – 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

Features of Fiber Sizing Market

• Market Size Estimates: Global fiber sizing market size estimation in terms of value ($M) and volume (M lbs)

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

• Segmentation Analysis: Market size by end use, component type, fiber type, film former type, and region

• Regional Analysis: Global fiber sizing market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

• Growth Opportunities: Analysis of growth opportunities in different end use, component type, fiber type, film former type, and region for the fiber sizing market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the fiber sizing market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in fiber sizing or adjacent markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

Frequently Asked Questions (FAQ)

Q1. What is the fiber sizing market size?

Answer: The global fiber sizing market is expected to reach an estimated $822 million by 2030.

Q2. What is the growth forecast for fiber sizing market?

Answer: The fiber sizing market is expected to grow at a CAGR of 3% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the fiber sizing market?

Answer: The major drivers for this market are increasing demand for reinforced composite materials and the performance benefits of sizing in fiber.

Q4. What are the major end uses for fiber sizing?

Answer: Transportation and wind energy are the major end uses for fiber sizing

Q5. What are the emerging trends in fiber sizing market?

Answer: Emerging trend, which has direct impact on the dynamics of the fiber sizing industry, includes sustainability focus, development of advanced materials, increasing use of customization and specialization, focus on lightweight and global expansion and partnership.

Q6. Who are the key fiber sizing companies?

Answer: Some of the key fiber sizing companies are as follows:

• Hexion

• COIM

• Michelman

• Covestro

• Polymer Chemistry Innovation Inc.

• Alliancys

• Evonik

Q7.Which fiber sizing material segment will be the largest in future?

Answer: Lucintel forecasts that the glass fiber will remain the largest segment by value and volume. Sizing for carbon fiber is expected to witness the highest growth over the forecast period due to the growing demand for carbon fiber in different end uses.

Q8: In fiber sizing market, which region is expected to be the largest in next 7 years?

Answer: APAC is expected to remain the largest region and ROW witness the highest growth over next 7 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following key questions

Q.1 How big the opportunities for global fiber sizing market by end use (transportation, pipe and tank, construction, electrical and electronics, wind energy, consumer goods, marine, and others), component type (film former, coupling agent, additives and modifiers), fiber type (glass fiber, carbon fiber, and others), film former type (phenoxy film former, epoxy based film former, polyamide based film former, PP based film former, PU based film former, and other film former), and region (North America, Europe, Asia Pacific and the Rest of the World)?

Q. 2 Which segments will grow at a faster pace and why?

Q.3 Which regions will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

Q.5 What are the business risks and threats to the market?

Q.6 What are the emerging trends in this market and the reasons behind them?

Q.7 What are the changing demands of customers in the market?

Q.8 What are the new developments in the market? Which companies are leading these developments?

Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M & A activities have taken place in the last 5 years in this market?