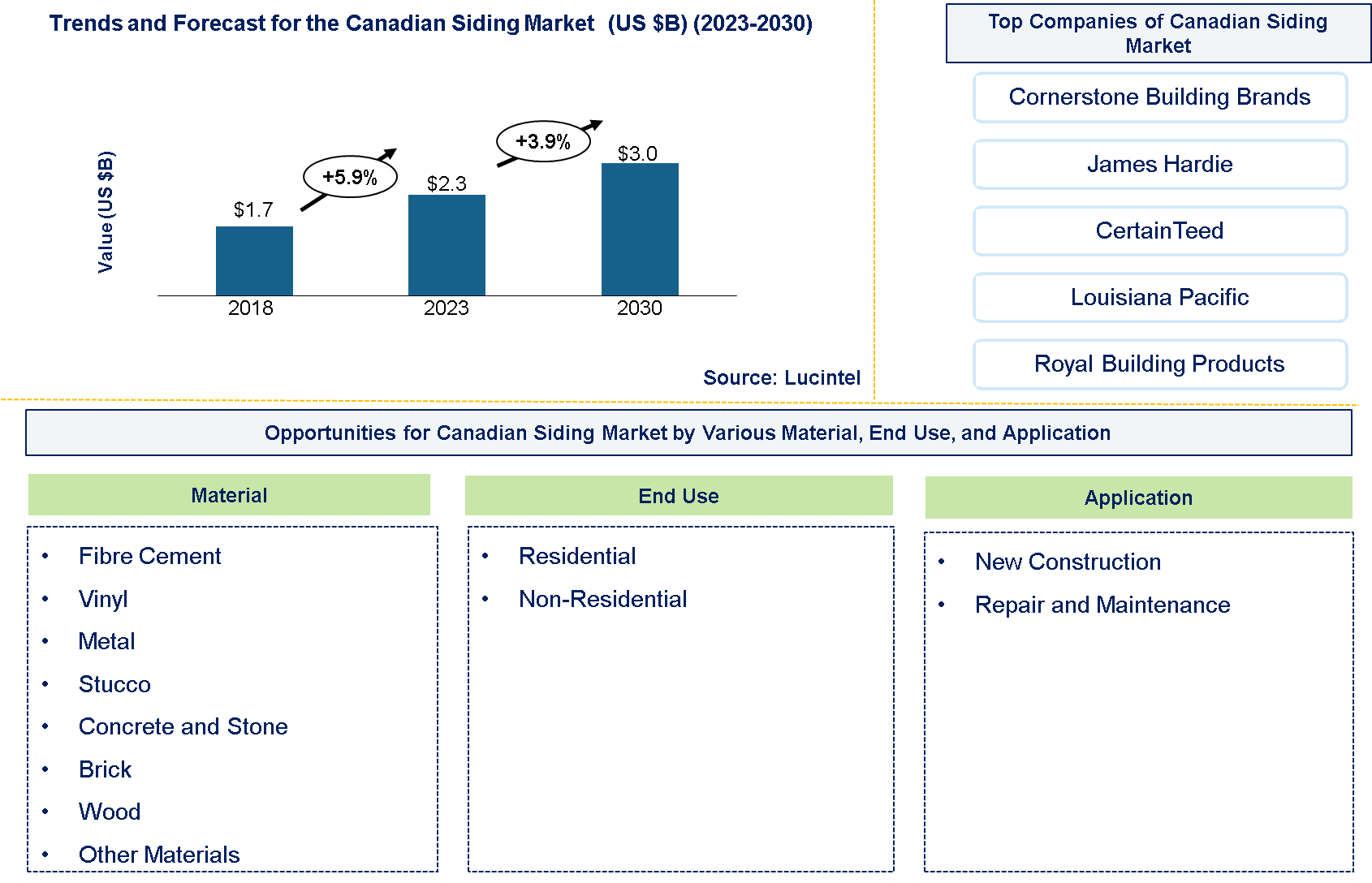

Canadian Siding Market Trends and Forecast

The future of the Canadian siding market looks promising with opportunities in non-residential and residential construction. The Canadian siding market is expected to reach an estimated $3 billion by 2030, and it is forecast to grow at a CAGR of 3.9% from 2023 to 2030.The major growth drivers for this market are increasing construction activities, growing repair and maintenance of building exteriors, and a rise in the hospitality industry.

The Canadian siding market primarily utilizes materials such as vinyl, fiber cement and wood are extensively used in the Canadian siding market. It is cheaper to buy and maintain vinyl siding than other types. Fiber cement is durable and can withstand any weather condition, including termites attack. For long, wood has been considered a classical option because of its natural look though today oriented-strand board is replacing it for being eco-friendly while at the same time performing better. Different consumer preferences and Canada's regulatory requirements on sidings have led to the availability of a variety of products that make this industry grow strong. The cost dynamics of Canadian siding market differ with respect to material and quality. Relatively speaking, vinyl sidings are more affordable compared with fiber cement or wooden ones hence preferred by price-sensitive consumers. High endurance and low maintenance make fiber cement sidings pricier than all other options in the category whereas prices of wood siding materials may differ significantly depending on species and finish.

• Lucintel forecasts that the fibre cement will remain the largest material type over the forecast period due low material and maintenance cost and availability of wide variety of colors.

• Within the Canadian siding market, residential will remain the largest as well as fastest end use market during the forecast period due to increasing adoption of energy efficient homes.

• Ontario is expected to remain the largest market and witness the highest growth over the forecast period, due to growth in the building and construction industry

Country wise Outlook for the Canadian Siding Market

The Canadian siding market is experiencing significant global growth, buoyed by heightened demand across diverse industries such as construction, real estate development, and renovation sectors. This growth is fueled by innovations in eco-friendly materials like fiber cement and engineered wood, catering to increasing consumer preference for sustainable building solutions. Below image highlights recent developments by major Canadian siding market producers in key regions: Canada.

Emerging Trends in the Canadian Siding Market

Emerging trends in the Canadian siding market shaping its future applications and market dynamics:

• Utilization of Technological Advancement: The utilization of state-of-the-art production techniques in siding development has provided for improvement in their strength, energy rating and beauty.

• Integration of Smart Technology : The integration of smart technologies into building materials is a growing trend in the construction industry, including siding. Smart siding solutions may include integrated sensors for moisture detection, temperature monitoring, or even solar-integrated panels that contribute to energy generation.

• Reducing Heating and Cooling Costs: Insulated sidings are becoming preferable due to improved thermal performances that minimize heat loss thereby reducing heating and cooling costs.

• Expansion of Urbanization Effects: Urban expansion is increasing the need for modern types of siding that satisfy aesthetic and functional needs in high density settings.

A total of 119 figures / charts and 113 tables are provided in this 306-page report to help in your business decisions. A sample figure with insights is shown below.

Recent Developments in the Canadian Siding Market

Recent developments in Canadian siding market which highlights ongoing innovations and advancements across different sectors:

1. Need for More Energy Efficient Siding: There is a growing demand in the Canadian siding market for energy-efficient siding materials that help improve insulation and reduce heating and cooling costs. Insulated vinyl siding, fiber cement siding, engineered wood sidings with enhanced thermal performance among others are becoming popular to homeowners and contractors.

2. Sustainable Construction Material: The move towards more sustainable constructions is shaping developments in the Canadian siding industry which now give priority to eco-friendly materials like fiber cement, engineered wood and recycled vinyl sidings. To address customer’s requirement of environmentally friendly products, manufacturers are providing recyclable sidings with low VOCs emissions and long life span.

3. Technological Advancements of Siding Products: Researches and ongoing development projects have resulted in technological advancements in the field of siding materials leading to durability improvements as well as weather resistance characteristics as well as aesthetic appeal. In Canada for instance this includes advanced coating systems, embossing textures or color retention technologies that help improve their quality standards making them better performing visually appealing brands.

4. Focus on Maintenance-Free Solutions: Many home owners in Canada are searching for low maintenance cladding solutions which need minimum care but have high service capability. For example, Canadian customers prefer vinyl sidings that can be easily cleaned with composite or fiber cement cladding products requiring little maintenance such as those resistant to rotting, pests' invasion including weather effects.

5. Increase in Design Alternatives: For instance, manufacturers of sidings are continuously expanding their product mix so that it can satisfy different architectural preferences of consumers within Canadian market. This range includes various colors, textures profiles, finishes of vinyl sidings among others commonly being used today by different building designers who want to match up with many architectural styles as well as individual consumption tastes.

6. Market Response to Weather Extremes: The Canadian siding market is adapting to climate challenges such as extreme cold temperatures heavy precipitation (rainfall) patterns adjusted by wind and sun light. Weather proofing properties such as high resistance to moisture, freeze-thaw cycles and UV degradation are required for siding materials that will last long under Canadian conditions.

Strategic Growth Opportunities for Canadian Siding Market

The Canadian siding market is very dynamic due to its unique properties of being responsive to climate demands and offering diverse aesthetic options, driving innovation and market competitiveness. Some key strategic growth opportunities for this market include:

Sustainable Materials and Green Building Practices:

• There is a growing preference for sustainable siding materials that minimize environmental impact and enhance energy efficiency in buildings. Canadian consumers and builders increasingly prioritize products made from renewable and recyclable materials such as engineered wood, fiber cement, and vinyl with recycled content. Manufacturers focusing on eco-friendly certifications like LEED (Leadership in Energy and Environmental Design) can capitalize on this trend.

Technological Advancements in Manufacturing and Installation:

• Innovations in siding manufacturing processes and installation techniques are enhancing product durability, efficiency, and aesthetics. Technologies such as advanced coatings for weather resistance, modular siding systems for quicker installation, and digital tools for precise measurement and customization are gaining traction. Companies investing in R&D to improve product performance and reduce installation times stand to gain competitive advantage.

Expansion of Renovation and Retrofit Market:

• The Canadian housing stock is aging, creating a robust market for siding replacements and renovations. Homeowners are upgrading siding to improve curb appeal, energy efficiency, and property value. Manufacturers and contractors offering innovative siding solutions tailored for retrofit projects, such as insulated siding systems and easy-to-install options, are well-positioned to capture this growing market segment.

Shift towards High-Performance and Low-Maintenance Products:

• There is increasing demand for low-maintenance siding products that offer long-term durability and minimal upkeep. Products resistant to fading, warping, and insect damage, such as fiber cement and composite siding, are favored for their longevity and aesthetic appeal. Manufacturers innovating with new materials and finishes that require less frequent maintenance can attract discerning homeowners and builders.

Regional and Climate-Specific Solutions:

• Canada's diverse climate conditions-from coastal regions to harsh northern winters-require siding solutions that can withstand varying temperatures, moisture levels, and environmental stresses. Companies offering region-specific siding products engineered for durability, thermal performance, and moisture resistance tailored to local climates can address specific market needs effectively.

Strategic Partnerships and Market Expansion:

• Collaborations between manufacturers, distributors, and contractors can enhance market penetration and expand product offerings. Partnerships that leverage distribution networks, regional expertise, and customer relationships enable companies to reach new customer segments and geographical markets across Canada.

Government Incentives and Regulations:

• Government initiatives promoting energy-efficient building practices and sustainable construction materials provide opportunities for growth. Incentives such as grants, tax credits, and rebates for energy-efficient upgrades encourage adoption of high-performance siding products. Manufacturers aligning their product offerings with these incentives can attract customers looking to reduce energy costs and environmental footprint.

By taking advantage of these strategic growth opportunities, the Canadian siding market can realize its full potential and transform numerous industries through innovative material advancements and sustainable construction practices, influencing architectural trends and enhancing environmental stewardship.

Canadian Siding Market Driver and Challenges

Canadian siding market plays a pivotal role across industries such as construction, real estate development, renovation, and building materials manufacturing. In construction, siding is crucial for enhancing building aesthetics, durability, and energy efficiency, meeting both residential and commercial building codes. However, challenges such as production costs underscore the need for strategic solutions to sustain growth and innovation in the Canadian siding sector.

The key drivers for the Canadian siding market include:

1. Sustainable Solution Demand: Fiber cement and engineered wood are examples of ecological materials used as siding because of the consumer’s growing concern about sustainability in construction.

2. Technological Advancement: The improved manufacturing processes enhance product strength, energy conservancy, and design beauty so as to meet the changing customer taste.

3. Urbanization and Construction Boom: Need for contemporary sidings that can improve buildings’ aesthetics and performance is on the rise due to urban growth.

The challenges facing the Canadian siding market include:

1. Cost Factor: Initial high cost could discourage some consumers from using green material thus lowering its acceptance rate.

2. Regulation Adherence: Complying with strict environmental regulations and building code increases the complexity and cost of designing and marketing a product.

3. Market Competitiveness: Continuous innovation and differentiation is essential for firms to compete effectively in a crowded market where there is a lot of rivalry among suppliers.

Innovations in material science and manufacturing processes have led to a strong demand for Canadian siding. Unique developments include engineered wood composites for enhanced durability and aesthetic versatility, eco-friendly fiber cement options offering low maintenance and fire resistance, and advanced vinyl formulations providing superior weather resistance and color retention, driving market growth and consumer preference.

Canadian Siding Suppliers and Their Market Shares

In this globally competitive market, several key players such as Cornerstone Building Brands., James Hardie, Saint-Gobain, Louisiana Pacific Corporation, Royal Building Products, etc. dominate the market and contribute to industry’s growth and innovation. These players capture maximum market share. To know the current market share of each of major players contact us.

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies, siding companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the major siding companies profiled in this report include-

• Cornerstone Building Brands

• James Hardie

• Saint-Gobain

• Louisiana Pacific Corporation

• Royal Building Products

These companies have established themselves as leaders in the Canadian siding industry, with extensive product portfolios, global presence, and strong research and development capabilities. They continually strive to enhance their market positions through strategic partnerships, mergers and acquisitions, and product innovations.

The market share dynamics within the Canadian siding market are evolving, with the entry of new players and the emergence of innovative Canadian siding technologies. Additionally, collaborations between material suppliers, manufacturers, and end-users are fostering technological advancements and expanding market opportunities.

Canadian Siding Market by Segment

Major segments experiencing growth include fiber cement siding, appreciated for its durability, resistance to weather elements, and low maintenance requirements. Engineered wood siding is also on the rise, offering a sustainable alternative with enhanced moisture resistance and aesthetic appeal resembling natural wood. Additionally, vinyl siding remains popular for its affordability, versatility in design options, and ease of installation, catering to diverse consumer preferences across residential and commercial applications. These segments underscore a trend towards durable, eco-friendly, and visually appealing siding solutions in Canada's construction and renovation sectors.

This Canadian siding market report provides a comprehensive analysis of the market's current trends, growth drivers, challenges, and future prospects in all major segments like above. It covers various segments, including Canadian siding market types, material, end use, and application. The report offers insights into regional dynamics, highlighting the major markets for Canadian siding market and their growth potentials. The study includes trends and forecast for the global Canadian siding market by material, end use, application, and territory as follows:

Canadian Siding Market by Material [Value ($ Million) analysis from 2018 to 2030]:

• Fiber Cement

• Vinyl

• Metal

• Stucco

• Concrete and Stone

• Brick

• Wood

• Other Materials

Canadian Siding Market by End Use [Value ($ Million) analysis from 2018 to 2030]:

• Residential

• Non-Residential

Canadian Siding Market by Application [Value ($ Million) analysis from 2018 to 2030]:

• New Construction

• Repair and Maintenance

Canadian Siding Market by Territory [Value ($ Million) analysis from 2018 to 2030]:

• Quebec

• British Columbia

• Alberta

• Ontario

• Others

Features of the Canadian Siding Market

• Market Size Estimates: Canadian siding market size estimation in terms of value ($M) shipment.

• Trend and Forecast Analysis: Market trends (2018-2023) and forecast (2024-2030) by various segments and territories.

• Segmentation Analysis: Canadian siding market size by various segments, such as material, application, end use, and territories in terms of value.

• Regional Analysis: Canadian siding market breakdown by Quebec, British Columbia, Alberta, Ontario, and others.

• Growth Opportunities: Analysis on growth opportunities in different materials, applications, end uses, and territories of the Canadian siding market.

• Strategic Analysis: This includes M&A, new product development, and competitive landscape for the Canadian siding market.

• Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

If you are looking to expand your business in Canadian siding markets, then contact us. We have done hundreds of strategic consulting projects in market entry, opportunity screening, due diligence, supply chain analysis, M & A, and more.

FAQ

Q1. What is the siding market size?

Answer: The Canadian siding market is expected to reach an estimated $3 billion by 2030.

Q2. What is the growth forecast for siding market?

Answer: The siding market is expected to grow at a CAGR of 3.9% from 2024 to 2030.

Q3. What are the major drivers influencing the growth of the siding market?

Answer: The major growth drivers for this market are increasing construction activities, growing repair and maintenance of building exteriors, and a rise in the hospitality industry.

Q4. What are the major applications or end use industries for siding?

Answer: Residential and non-residential are the major end use industries for siding.

Q5. What are the emerging trends in the siding market?

Answer: Emerging trends which have a direct impact on the dynamics of the market include utilization of technological advancement, integration of smart technology, reducing heating and cooling costs and expansion of urbanization effects.

Q6. Who are the key siding companies?

Answer: Some of the key siding companies are as follows:

• Cornerstone Building Brands

• James Hardie

• Saint-Gobain

• Louisiana Pacific Corporation

• Royal Building Products

Q7.Which will be the largest siding material segment in the future?

Answer: Lucintel forecasts that the vinyl will remain the largest material type over the forecast period due low material and maintenance cost and availability of wide variety of colors.

Q8: In siding market, which territory is expected to be the largest in next 5 years?

Answer: Ontario is projected to be the largest territory and witness the highest growth over the next 5 years.

Q9. Do we receive customization in this report?

Answer: Yes, Lucintel provides 10% customization without any additional cost.

This report answers following 11 key questions

Q1 What are some of the most promising, high-growth opportunities for the Canadian siding market by material (fiber cement, vinyl, metal, stucco, concrete and stone, brick, wood, and other materials), end use (residential and non-residential), application (new construction and repair and maintenance), and territory (Quebec, British Columbia, Alberta, Ontario, and others )?

Q.2 Which segments will grow at a faster pace and why?

Q.3 Which territory will grow at a faster pace and why?

Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the Canadian siding market?

Q.5 What are the business risks and threats to the Canadian siding market?

Q.6 What are emerging trends in this Canadian siding market and the reasons behind them?

Q.7 What are some changing demands of customers in the Canadian siding market?

Q.8 What are the new developments in the Canadian siding market? Which companies are leading these developments?

Q.9 Who are the major players in the Canadian siding market? What strategic initiatives are being implemented by key players for business growth?

Q.10 What are some of the competitive products and processes in the Canadian siding market, and how big of a threat do they pose for loss of market share via material or product substitution?

Q.11 What M&A activities did take place in the last five years in the Canadian siding market?

For any questions related to Canadian siding market or related to siding manufacture, siding market, siding market size, siding market trends, siding market research, and siding manufacturer, siding companies, siding market share, siding market analysis, siding market size, write Lucintel analyst at email: helpdesk@lucintel.com. We will be glad to get back to you soon.