Automotive Lead Acid Battery Market Trends and Forecast

The automotive lead acid battery market has changed dramatically in the past few years, with a shift from traditional SLI (starting, lighting, ignition) batteries used exclusively in conventional IC engine vehicles to the latest advancements in more sophisticated micro-hybrid batteries that enable start-stop technologies, thereby allowing for higher fuel economy and reduced emissions. This reflects the rising demand for energy-efficient vehicle systems, especially in light of the increased uptake of micro-hybrid vehicles featuring regenerative braking and frequent engine on/off cycles that require more robust charging and discharging performance from the batteries. Moreover, improvements in battery life, charging efficiency, and weight reduction have been pivotal in the evolution of automotive lead acid batteries, positioning them as more viable for modern automotive applications while also competing with alternatives like lithium-ion batteries in certain vehicle segments.

Emerging Trends in the Automotive Lead Acid Battery Market

The automotive lead acid battery market is seeing several significant trends, driven by changing consumer needs, technological advancements, and regulatory pressures. Below are the key emerging trends reshaping the market:

• Increase in Micro-Hybrid Vehicles: The advent of micro-hybrid vehicles that employ a stop-start system to improve fuel economy and reduce emissions has led to a growing market for advanced lead acid batteries optimized for the high cycling requirements of this technology. Micro-hybrid batteries are increasingly finding application in passenger cars and commercial vehicles.

• Improved Battery Performance and Long Life: The improvement of lead acid performance, longevity, and efficiency is an investment made by manufacturers to improve their performance in applications for micro-hybrids. Deep-cycle capabilities and higher charging rates have improved the automotive lead acid battery, making it more competitive with lithium-ion alternatives for specific applications.

• Environmental Benign Solutions: As public concern for the environment rises, there is an increasing need for automobile batteries to be eco-friendly and recyclable. Lead acid batteries are most preferred because of their relatively high recyclability rate, which promotes sustainability in the automotive industry, especially as vehicle electrification trends prevail.

• The Progression Towards Dual-Voltage Systems: Modern vehicles, especially in the premium and electric vehicle (EV) segments, are gradually including dual voltage systems for optimal energy utilization in both conventional and electric powertrains. As such, these vehicles have great demand for advanced lead-acid batteries that can easily handle both 12V and 48V systems.

• Regulatory Push for Fuel Efficiency and Emissions Reduction: The regulatory push for fuel efficiency and emissions reduction is an incentive for the promotion of energy-efficient battery technologies in vehicles. Automotive lead acid batteries, particularly those used in micro-hybrid systems, play an essential role in helping manufacturers meet these regulatory requirements.

The micro-hybrid development, improved battery performance, and the need for eco-friendly solutions, along with the growth of dual-voltage systems, are reshaping the automotive lead acid battery market. The emissions-reducing pressure from regulatory authorities will further emphasize the importance of lead acid technology in the evolution of power systems for vehicles.

Automotive Lead Acid Battery Market : Industry Potential, Technological Development, and Compliance Considerations

The automotive lead-acid battery market has been a cornerstone of the automotive industry for over a century, primarily used for starting, lighting, and ignition (SLI) applications in vehicles. While lithium-ion batteries are gaining traction in electric vehicles (EVs), lead-acid batteries remain prevalent in traditional gasoline and diesel-powered vehicles due to their affordability, reliability, and proven technology.

• Technology Potential: The technology potential for automotive lead-acid batteries lies in further improving their performance, energy density, and lifespan. Advances in battery design, such as enhanced electrolyte formulations and optimized plate structures, are helping to boost efficiency and reduce the environmental impact of lead-acid batteries. Additionally, innovations like absorbent glass mats (AGM) and enhanced flooded batteries (EFB) are increasing power delivery, cycle life, and deep discharge capabilities, which are key for modern vehicle demands, including start-stop systems and more energy-hungry electronics.

• Degree of Disruption: The degree of disruption in the lead-acid battery market is moderate. While lithium-ion technology is making inroads, especially in EVs, lead-acid batteries remain dominant in conventional vehicles due to their lower cost and well-established infrastructure. However, as EV adoption grows, the demand for lead-acid batteries in new vehicles may slow.

• Level of Current Technology Maturity: Lead-acid battery technology is highly mature, with well-established manufacturing processes. While ongoing innovations continue to enhance performance, the fundamental technology remains largely unchanged.

• Regulatory Compliance: Lead-acid batteries are subject to strict environmental regulations, such as the U.S. EPA’s standards for lead management and the European Union’s Battery Directive. These regulations ensure proper recycling and disposal practices to minimize environmental impact.

Recent Technological development in Automotive Lead Acid Battery Market by Key Players

Key players in the automotive lead acid battery market are making strategic steps forward to improve their product portfolios and drive large volumes of demand for energy-efficient automotive batteries. Some of the recent developments are as follows:

• Camel Group: Camel Group has been heavily focused on high-performance lead acid solutions, specifically aimed at the ever-growing micro-hybrid and start-stop vehicle market. Innovations have targeted improvements in cycle life and charging efficiency, making them more suitable for advanced automotive applications.

• C&D Technologies: C&D Technologies now offers advanced lead acid batteries catering to micro-hybrid and electric vehicle applications. Its improvements in battery capacity and energy storage efficiency have helped it gain a greater share of the increasing market for high-performance automotive batteries in OEM and aftermarket segments.

• Clarios: Clarios has been at the forefront of leading research on advanced start-stop batteries, ensuring developments meet the requirements for both conventional and micro-hybrid vehicles. Their efforts to improve battery life and performance while reducing weight and increasing energy density have helped them maintain a strong market position.

• CSB Energy Technology: With innovations in the lead acid battery space, CSB Energy is backing the performance of hybrid and electric vehicle energy storage. By upgrading the cycling capabilities and power retention of their batteries, CSB Energy has become a leader in the micro-hybrid market.

• East Penn Manufacturing: East Penn has invested significantly in the production of advanced lead acid batteries for OEM and aftermarket solutions. The Deka brand of micro-hybrid batteries is gaining traction through improvements in energy efficiency and longer service life.

• Enersys: Enersys has concentrated its R&D efforts on creating lead-acid batteries with enhanced deep-cycle capabilities and higher charge/discharge efficiency for the commercial vehicle and automotive industries. Its latest investments in R&D are aimed at improving the durability and sustainability of lead-acid batteries.

• Exide Industries: Exide has developed its product range with highly advanced lead-acid batteries for micro-hybrid vehicles. Their innovations help save energy and extend battery life, supporting their aim to design more efficient and eco-friendly products for vehicle applications.

• GS Yuasa Corporation: GS Yuasa is actively working to improve its automotive lead acid battery technology for start-stop systems and micro-hybrid vehicles. Their focus on product development has resulted in more robust, higher-performance batteries that are increasingly being included in new vehicle models.

• Koyo Battery: Koyo Battery has engineered new lead acid battery solutions tailored for conventional and electric vehicles. Their products ensure energy density improvements and enhanced overall battery performance, focusing on fulfilling the increased demand for reliable power in automotive applications.

These developments showcase how the leading players in the market are innovating performance, sustainability, and competitiveness through better lead acid batteries, meeting the demands across the modern automotive market.

Automotive Lead Acid Battery Market Driver and Challenges

The automotive lead acid battery market is influenced by several drivers and challenges that shape its growth and adoption. Below are the key drivers and challenges:

The factors responsible for driving the automotive lead acid battery include:

• Micro-Hybrid Vehicles: There is increasing demand for micro-hybrid vehicles, which are mainly based on start-stop technology. These vehicles require batteries that can withstand repeated charging and discharging cycles; the market for lead-acid solutions for this application is also growing.

• Government Regulations on Emissions and Fuel Efficiency: Stricter regulations on vehicle emissions and fuel efficiency are driving automakers to adopt more efficient energy solutions, including lead acid batteries for start-stop systems. These batteries play a crucial role in meeting regulatory requirements while improving vehicle efficiency.

• Lead Acid Batteries Remain Cost-Effective: Lead acid batteries are relatively less expensive compared to other alternatives like lithium-ion, which remain the most preferred by budget-conscious consumers and manufacturers alike. Their cost-effectiveness, combined with their recyclability, ensures lead-acid batteries remain relevant in automotive applications.

• Advancement in Technology for Lead Acid Batteries: Advancements in lead acid battery technology would attract customers due to enhanced charge/discharge efficiency, longer life cycles, and greater operating performance under extreme temperatures. All these factors continue to attract more micro-hybrid and commercial vehicle users.

Challenges in the automotive lead acid battery include:

• Competition with Lithium-Ion Batteries: Lithium-ion batteries, with higher energy density and longer lives, increasingly function as substitutes for lead acid batteries in electric vehicles and high-performance automotive applications. This competition could dampen the continued growth of the lead acid battery market.

• Environmental Concerns Regarding Lead Recycling: Although lead acid batteries can be recycled, the extraction of lead and the disposal of lead acid batteries pose environmental barriers. The automotive industry is increasingly being pressured to adopt less lead-based batteries and seek more environmentally friendly alternatives.

• Inefficiencies in Energy Density and Performance: Lead acid batteries cannot match the performance or energy density of newer technologies, thus their implementation in electric and hybrid vehicles may be limited. Innovation in lead acid battery technology should continue to improve the value proposition relative to the rapidly changing automotive market.

The growth of micro-hybrid vehicles, stricter regulatory requirements, cost-effectiveness, and technological advancements are some of the drivers in the automotive lead acid battery market. However, challenges such as competition from lithium-ion batteries, environmental concerns, and limitations in performance require innovations to maintain the lead acid battery’s position in the automotive market. These factors are shaping the future of automotive lead acid battery technologies.

List of Automotive Lead Acid Battery Companies

Companies in the market compete based on product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies, automotive lead acid battery companies cater to increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the automotive lead acid battery companies profiled in this report includes.

• Camel Group

• C&D Technologies

• Clarios

• Csb Energy Technology

• East Penn Manufacturing

• Enersys

Automotive Lead Acid Battery Market by Technology

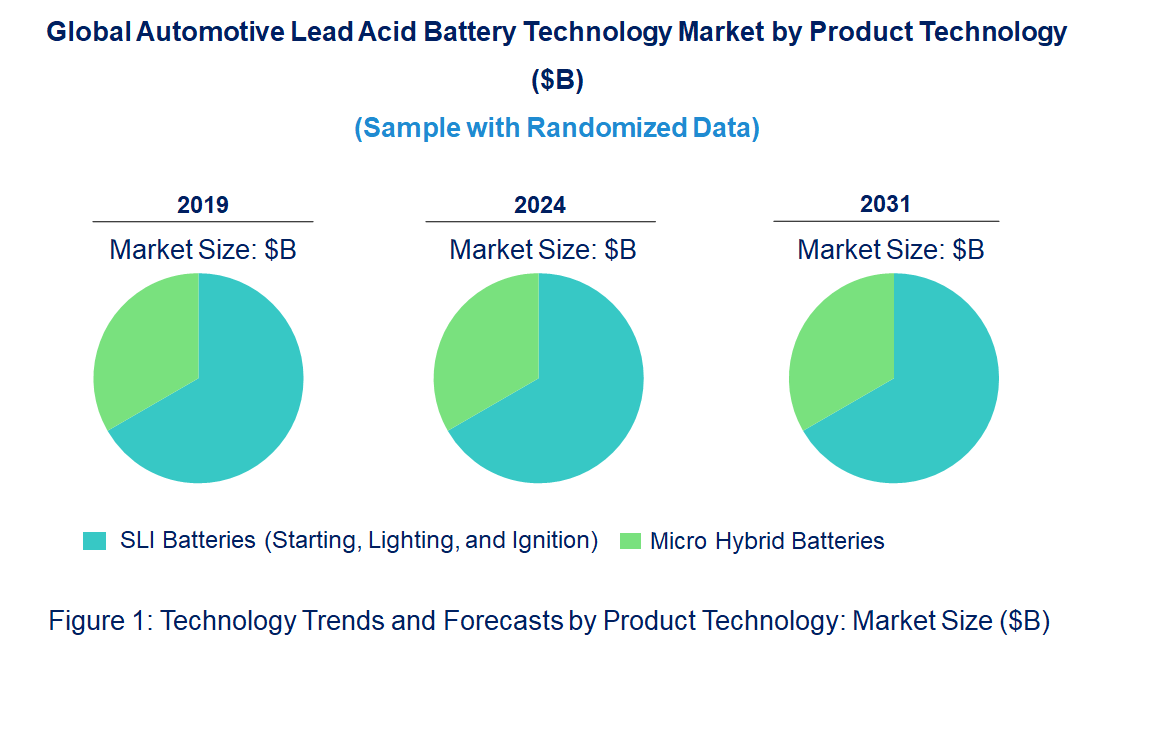

• Potential For SLI and Micro-Hybrid Batteries To Disrupt the Automotive Lead Acid Battery Market: For years, SLI (Starting, Lighting, and Ignition) batteries have driven the automotive lead acid battery market, providing power to start vehicles, lighting, and ignition systems. However, with the shift toward more energy-efficient and environmentally friendly solutions, micro-hybrid batteries are becoming the reason for disruption by integrating conventional SLI batteries with energy recovery systems, such as regenerative braking. Micro-hybrid batteries offer higher fuel efficiency, lower emissions, and better power management by capturing and storing braking energy. This technology is set to disrupt the lead acid battery market, particularly in mid-range vehicles, where fuel efficiency standards are rising. Although SLI batteries will still hold a larger share in older models, the trend towards micro-hybrid vehicles could drastically alter the automotive battery industry.

• Competitive Intensity and Regulatory Compliance for SLI and Micro-Hybrid Batteries: The competitive intensity between SLI batteries and micro-hybrid batteries in the automotive lead acid battery market is increasing, driven by the demand for fuel-efficient and environmentally friendly vehicles. SLI batteries are well-established, with numerous manufacturers competing on price, quality, and longevity, while micro-hybrid batteries are gaining traction due to stricter emissions regulations and growing consumer demand for energy-efficient vehicles. Regulatory compliance is crucial for both technologies, especially with the global focus on reducing automotive emissions and improving fuel economy. SLI batteries must comply with regulations concerning lead recycling and environmental safety standards, while micro-hybrid batteries must meet energy efficiency, safety, and waste management standards. The growing regulatory landscape will spur further innovation in energy storage systems, with increasing use of micro-hybrid technology to meet tougher fuel efficiency and CO2 emissions targets.

• SLI and Micro-Hybrid Battery Technology Maturity: SLI batteries are the most mature technology in the automotive lead acid battery market and are widely used in conventional vehicles for starting, lighting, and ignition purposes. These batteries are reliable, cost-effective, and well understood. However, their role is taking a back seat as micro-hybrid batteries become more prominent in new vehicle generations due to enhanced energy recovery features. Micro-hybrid batteries, a relatively newer technology, are increasingly ready for mass adoption as they include regenerative braking systems and other energy-saving measures. Competition is intense between the traditional SLI battery manufacturers and those developing advanced hybrid systems. Additionally, regulatory compliance is crucial for both technologies. SLI batteries must reduce lead content and ensure recycling best practices, while micro-hybrid batteries must comply with stricter energy efficiency and safety standards. The primary applications for SLI batteries remain in conventionally powered vehicles, while micro-hybrid batteries are increasingly installed in mid-range and higher-end vehicles as emissions regulations tighten globally.

Automotive Lead Acid Battery Market Trend and Forecast by Product Technology [Value from 2018 to 2030]:

• SLI Batteries (Starting, Lighting, and Ignition)

• Micro Hybrid Batteries

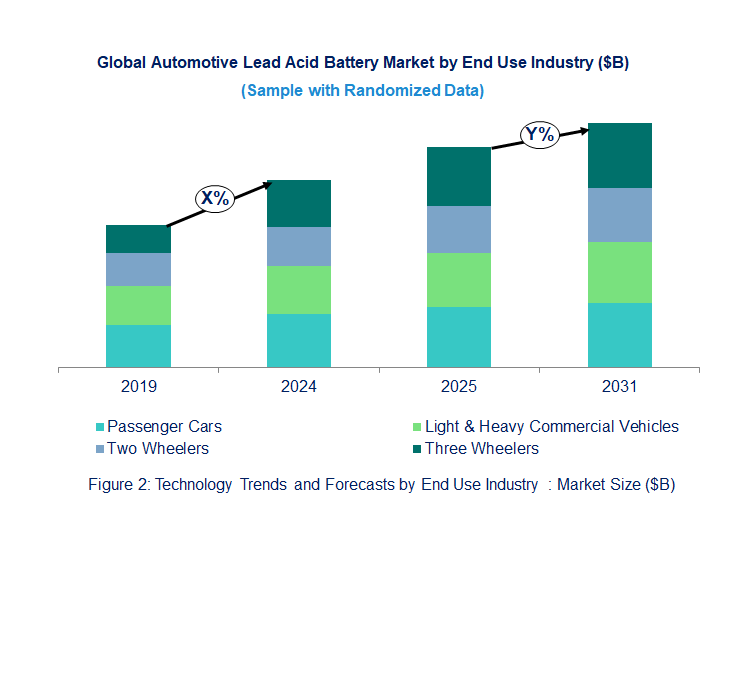

Automotive Lead Acid Battery Market Trend and Forecast by End Use Industry [Value from 2018 to 2030]:

• Passenger Cars

• Light & Heavy Commercial Vehicles

• Two Wheelers

• Three Wheelers

Automotive Lead Acid Battery Market by Region [Value from 2018 to 2030]:

• North America

• Europe

• Asia Pacific

• The Rest of the World

• Latest Developments and Innovations in the Automotive Lead Acid Battery Technologies

• Companies / Ecosystems

• Strategic Opportunities by Technology Type

Features of the Global Automotive Lead Acid Battery Market

Market Size Estimates: Automotive lead acid battery market size estimation in terms of ($B).

Trend and Forecast Analysis: Market trends (2018 to 2023) and forecast (2024 to 2030) by various segments and regions.

Segmentation Analysis: Technology trends in the global automotive lead acid battery market size by various segments, such as product technology and end use industry in terms of value and volume shipments.

Regional Analysis: Technology trends in the global automotive lead acid battery market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different end use industries, product technologies, and regions for technology trends in the global automotive lead acid battery market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape for technology trends in the global automotive lead acid battery market.

Analysis of competitive intensity of the industry based on Porter’s Five Forces model.

This report answers following 11 key questions

Q.1. What are some of the most promising potential, high-growth opportunities for the technology trends in the global automotive lead acid battery market by product technology (sli batteries (starting, lighting, and ignition) and micro hybrid batteries), end use industry (passenger cars, light & heavy commercial vehicles, two wheelers, and three wheelers), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

Q.2. Which technology segments will grow at a faster pace and why?

Q.3. Which regions will grow at a faster pace and why?

Q.4. What are the key factors affecting dynamics of different product technologies? What are the drivers and challenges of these product technologies in the global automotive lead acid battery market?

Q.5. What are the business risks and threats to the technology trends in the global automotive lead acid battery market?

Q.6. What are the emerging trends in these product technologies in the global automotive lead acid battery market and the reasons behind them?

Q.7. Which technologies have potential of disruption in this market?

Q.8. What are the new developments in the technology trends in the global automotive lead acid battery market? Which companies are leading these developments?

Q.9. Who are the major players in technology trends in the global automotive lead acid battery market? What strategic initiatives are being implemented by key players for business growth?

Q.10. What are strategic growth opportunities in this automotive lead acid battery technology space?

Q.11. What M & A activities did take place in the last five years in technology trends in the global automotive lead acid battery market?